As sustainability continues to go mainstream, industries are shifting priorities to focus on climate challenges and social impact in their strategic development plans. That’s a real opportunity for industrial hemp.

Hemp has outsize potential to replace polluting raw materials in a number of industries – from textiles to building materials to high-tech applications.

More importantly – and firstly – as governments increase funding to help industry reduce environmental impacts and create more sustainable economies long-term, serious money is coming into play in greenhouse gas reduction.

$3 trillion

The European Union (EU) envisions public and private funding of €1 trillion ($1 trillion) through the European Green Deal between now and 2030 to support a reduction in greenhouse gas emissions by 55% on the way to a climate-neutral economy by 2050.

In the U.S., the Biden administration has proposed $2 trillion in investments to address climate challenges, with a goal of reducing emissions by 50-52% from 2005 levels by 2030. The U.S. Department of Energy, the Environmental Protection Agency, and the Department of Agriculture are all to receive climate-related funding.

As major industries fall under stricter and stricter limits for the total amount of CO2 they may pump into the air, large polluters can purchase carbon credits to offset their emissions as they evolve into more sustainable operations. Growing hemp is an efficient way to produce those credits, and can be the “output” that brings the first real income to hemp farmers.

Public, private

The cash value of carbon credits is projected to grow significantly. According to a report by the World Bank, global carbon pricing revenue in 2021 increased by almost 60% from 2020 levels, to around $84 billion, and the global market for carbon credits could be worth $100 billion by 2030, driven by the increasing number of countries that have implemented carbon pricing schemes and trading platforms. With the supply of carbon offset credits expected to be limited, prices could reach as high as $224 per ton of CO2 by 2030, according to Statista.

See how hemp operators can avoid the carbon accounting scammers

Meanwhile, in an age of Corporate Social Responsibility (CSR) and Environmental, Social and Governance (ESG), private investors are increasingly looking for industries that are both profitable and sustainable.

Total ESG investing reached $2.5 trillion in 2022, and ESG funds perform on a par with traditional investment vehicles, according to Bloomberg Intelligence. Similarly, CSR is now an essential part of doing business, with global spending on such initiatives at around $16 trillion and projected to reach $24 trillion by 2025, the World Economic Forum has estimated.

Carbon for industry

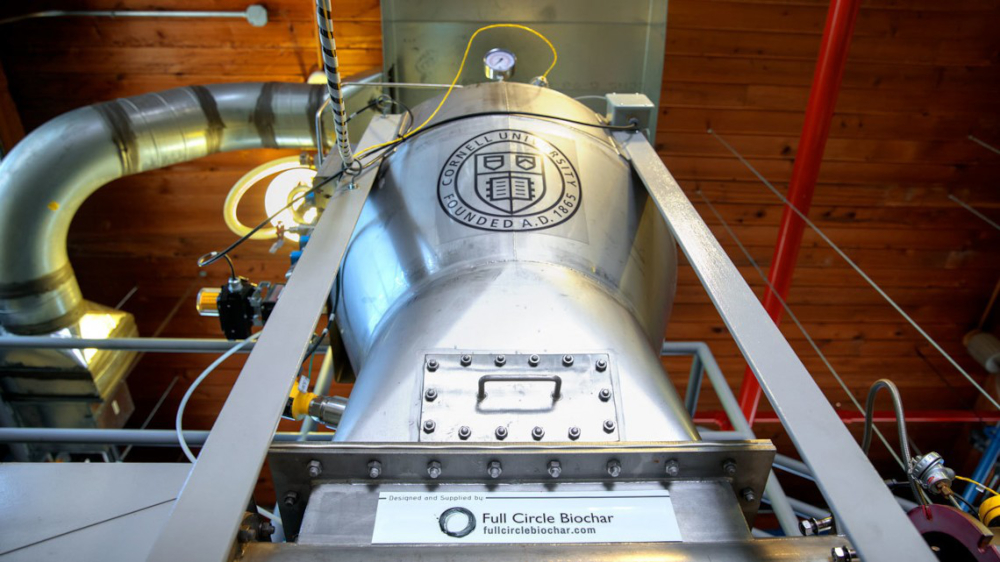

Beyond carbon credits themselves, hemp stalks can also be burned to make biochar, a raw material for downstream products that use solid forms of carbon – from simple water and air filters to high-tech applications such as batteries and fuel cells.

Unlike hemp building materials and textiles, which face strong long-term challenges from incumbents whose products are based on traditional raw materials, biochar (which can be made from any biomass waste) can simply stream into existing processing infrastructure – and a growing market.

More importantly for hemp operators, most of whom are small and independent, investments in smaller kilns needed to produce the material can be low as $10,000, and the end product is relatively inexpensive to produce. And perhaps most importantly, farmers who fail to find markets for their biochar can simply return it to enrich the soil, a practice which makes them eligible for tax breaks and subsidies under environmental programs in some countries.

Cashing in

How can hemp gain a greater voice in efforts to reduce climate change, and cash in in the process?

In addition to private investment and public financing, governments need to support the further expansion of carbon credit trading schemes for farming. That’s critical to convince farmers of the business case for integrating hemp into their crop rotations. Ecological benefits alone will not sell them on hemp.

Europe’s existing Emissions Trading System (ETS), which has shown success in reducing greenhouse gas emissions from key industrial sectors, is expected to embrace agriculture by 2024. Canada’s Agricultural Climate Solutions (ACS) program already operates a carbon trading scheme for farmers, and while the United States does not currently have a national carbon market for the agriculture sector, voluntary private markets are being developed to allow farmers to earn and sell credits.

Also, robust communications that go beyond “hemp can save the world” slogans are needed to continue to educate investors and policymakers about this valuable crop’s cash potential. To do that, the hemp industry must integrate itself into other industries, environmental groups and consumer advocacy groups, to promote everything hemp can be.

With its unrivaled potential to help heal the planet, hemp deserves more than a bit role in the process of environmental cleanup. The path to profits can be a long one, but given the urgency of the situation, it could happen faster than we think.