Most shareholders in U.S. CBD maker Charlotte’s Web withheld their votes for four directors during the company’s recent annual meeting, as a conflict between the founders and the current board is now fully in the open.

Ahead of Charlotte’s Web’s June 15 annual meeting, founding brothers Joel and Jesse Stanley sparked a skirmish in a June 12 press release, questioning the strategic direction of the company and calling for resignations from four of six current directors, including board President John Held and CEO Jacques Tortoroli.

The Stanleys called for strategic changes and nominated themselves to a slate of four candidates that would make up a reconstituted board to guide the struggling CBD pioneer.

Pushing back the next day, the current board criticized the Stanleys for angling to gain control over the Denver-based company in contravention of corporate by-laws, which the directors said would result in conflicts of interest.

‘Protecting shareholders’

“There are significant ongoing business relationships between Charlotte’s Web and entities in which Joel and/or Jesse hold direct or indirect interests, certain of which are or will be subject to Board review and approval in the near future,” the board said in a responding press release.

“This would effectively hand control of the Company to individuals of which at least two have significant conflicts of interest and who have elected to avoid appropriate vetting procedures. Such procedures are designed to, among other things, protect shareholders from conflicts of interest.

“The Board does not intend to abrogate its fiduciary responsibilities to shareholders by facilitating the removal of three independent Targeted Directors in favor of non-independents,” the board said in its response.

Board status now

Current directors were all re-elected during the annual meeting, but the Stanleys convinced more than 65% of shareholders to withhold votes for Held, Tortoroli and independent directors Thomas Lardieri and Alicia Morga – essentially an expression of no confidence.

“Given that certain of the directors received less than majority support at the Meeting, each such director has complied with the Company’s majority voting policy (the “Majority Voting Policy”) and has provided an offer to resign from the Board (the “Offers”) to the Board,” according to a post-meeting press notice from the directors. “The Board will, in accordance with the Majority Voting Policy, make a determination in due course on whether or not to accept any (resignation) Offers.”

Finger pointing

Votes were not withheld from current board members Susan Vogt and Jonathan Atwood, apparent allies of the Stanleys, who would presumably continue with the new board under the founders’ plan.

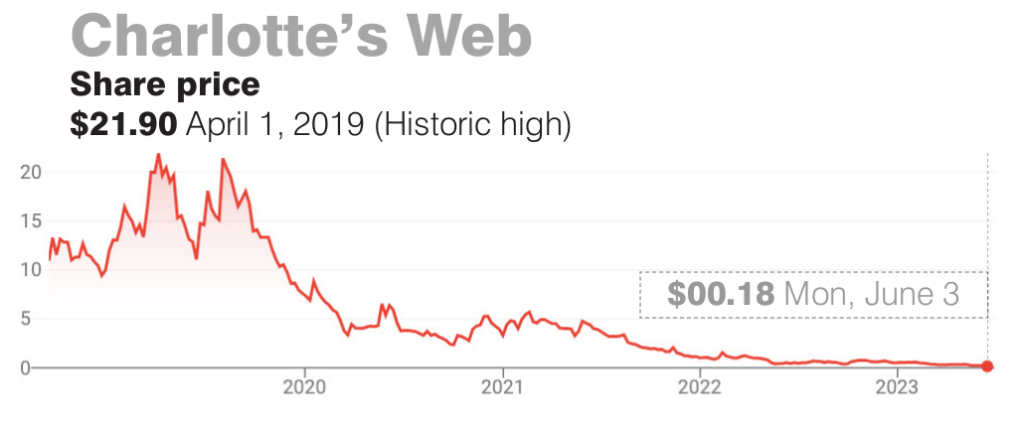

The finger-pointing at Charlotte’s Web comes as soft sales and regulatory uncertainty have caused the CBD sector to stagnate. The company had a net loss of $59.3 million on revenues of $74.1 million last year, according to its year-end financial statement. The Stanleys estimate losses have totaled $186 million in the two years ending March 31, 2023.

Downward slide

Charlotte’s Web shares closed Monday, July 3 at $0.1840 (about 18 cents) against an all-time high of $21.90 reached April 1, 2019. The company went public in September 2018 on the Toronto Stock Exchange and the OTCQX Venture Market in the U.S. – risky “penny stock” markets that are highly volatile.

In its Q1 2023 Report, Charlotte’s Web blamed its downward slide on decreasing demand for CBD tincture in the business-to-business and direct-to-consumer markets as customers turn to lower-priced gummies and topical products.

The Stanleys, on the other hand, blame the company’s struggles on strategic missteps, uncontrolled spending and poor hiring practices.