[This is the second in a series of stories looking at the CBD certification process in the UK]

Private CBD maker British Cannabis is so far the leader in the UK’s CBD sweepstakes after a total of 310 products associated with the company were recently advanced by regulators, analysis of a list released earlier this month by the Food Standards Agency (FSA) shows.

The Berkshire-based company received preliminary approval for 75 products submitted independently, and 235 it submitted jointly with other companies. A total of 3,536 products were preliminarily approved by FSA as new or “novel” foods, according to the list, released on March 31.

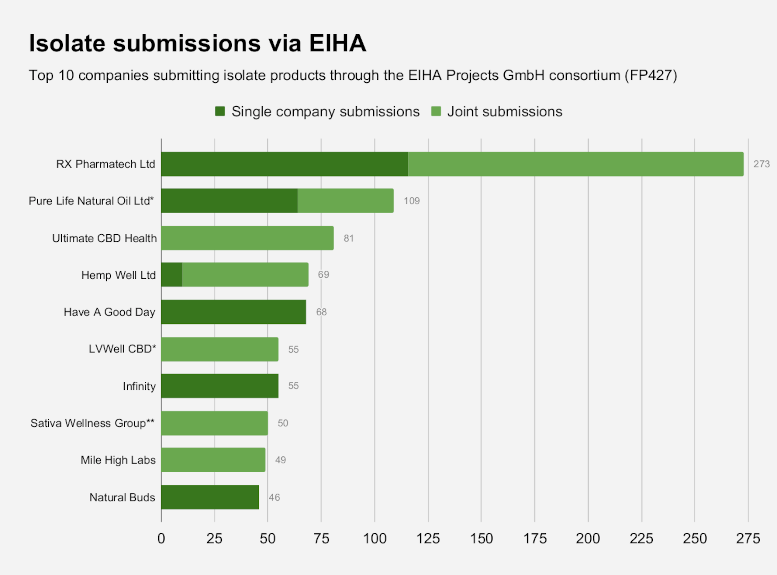

RX Pharmatech Ltd., Bradford, West Yorkshire, which has ties to U.S. cannabis interests, saw 273 products with which it is associated approved, the second-highest total. RX Pharmatech submitted 116 products independently, and 157 in tandem with other producers.

The UK’s market for consumer CBD products was estimated to be worth £690 million (~€814.5 million; ~$905.7 million) in 2021, according to the Association for the Cannabinoid Industry (ACI). From 2019 to 2021, CBD sales more than doubled in the UK, making the non-EU country the world’s second-biggest consumer market in the world behind the USA, ACI has said.

Companies remaining

Overall, 374 companies saw products advanced by the FSA. Some companies filed applications independently; some filed only as participants in joint applications with other producers, and some filed independently as well as jointly. The products were carried in a total of 70 applications for CBD submitted to the FSA.

While those products that made the list may remain on sale, those that failed FSA scrutiny are noncompliant and must be removed from the market. FSA has stressed that the approvals are preliminary and that some products could be eliminated at later stages of their review.

> See the full list of companies/products still “live” at FSA

Most of the products were advanced to pre-validation status (“awaiting evidence”), the second stage of the FSA’s novel food approval process. Fifty-seven products from five companies are now at the last stage of the process and await FSA’s final decision on full authorization.

Looking for clarity

FSA’s novel food approval process, first and foremost, is aimed at clarifying a flourishing gray market that has seen thousands of CBD products show up in retail outlets over the past several years. To qualify for consideration by the agency, those products already in distribution had to have been on the market before Feb. 13, 2020, under FSA guidelines. Any products introduced after that date were not eligible for consideration.

PART I: CBD makers push back against UK novel food review that critics say is flawed

British Cannabis’ products presumably came through a consortium organized by the ACI, of which it is a member according to the Association’s website. ACI this week said it is still analyzing the FSA list and declined to release information on the total number of products that came through its consortium or reveal the companies or the numbers for the applications (FPs) it submitted. However, at least 628 products from companies ACI lists as members – including those from British Cannabis – were among those that advanced.

EIHA’s applications

RX Pharmatech’s products were submitted by a separate consortium of the European Industrial Hemp Association (EIHA) which saw 1,992 CBD products preliminarily approved, accounting for roughly 56% of the total number advanced.

Products submitted through that consortium, EIHA Projects GmbH, came from 193 companies that were included in two EIHA applications covering isolates (1,157) and full-spectrum extracts (835).

*Submitted jointly by LVWell CBD, Essican Pure Life, Pure Life UK, Pure Life Natural Oil Ltd; same products filed as both FS and Isolates.

**Now known as Goodbody Health Inc.

> SEE ALL companies/products submitted as isolates via EIHA GmbH (RP427)

*Submitted jointly by LVWell CBD, Essican Pure Life, Pure Life UK, Pure Life Natural Oil Ltd; same products filed as both FS and Isolates.

> SEE ALL companies/products submitted as full-spectrum extracts via EIHA GmbH (RP438)

Top companies at-a-glance

Among the total of 374 companies associated with the full list of 3,536 products that advanced March 31, here’s a look at the top five based on the number of products each had approved by FSA, according to company websites and other public information:

British Cannabis

Established in 2015, British Cannabis is an independently owned, vertically integrated producer of marijuana, CBD and other cannabinoid products. The company makes own-brand products and supplies other brands on a white-label basis. British Cannabis has its own lab, manufacturing facility, warehouse and dispatch operations, and maintains a cannabis research farm in Portugal. The company claims to have shipped more than 50,000 bottles of CBD oils in the first half of 2021, between only two of its biggest white label clients, unidentified, but referred to as “two of the industry’s best-known brands.” British Cannabis announced in September 2021 that it was investing in a new facility that includes an ISO-accredited testing lab (British Cannabis Analytics) and a new cosmetics line – giving it the potential to triple its capacity. It operates one of 35 testing labs that make up the UK’s government “chemist ring trial” assessment for measuring CBD and cannabinoid content in commercial products.

Associated principals: Thomas Whettem, CEO & Founder; David Ralston, Managing Director

RX Pharmatech Ltd

Very little public information is available for RX Pharmatech Ltd., which apparently does not have a website. Public sources show the company was incorporated in May 2016, and is a supplier of bulk isolates and distillates produced by partners GVB Biopharma, Las Vegas, Nevada, USA. In addition to RX Pharmatech being a party to the second-highest number of products on the FSA list, GVB claimed in a press release April 7, 2022 that it is the largest supplier on the list to producers of white label formulations for oral tinctures, vape liquids, edibles, capsules and cosmetics. GVB said it sources raw materials from a U.S. farmers cooperative. According to the GVB’s website, the company has a UK office based in Doncaster, Yorkshire, England. GVB has one investor: Decathlon Capital Partners, a growth equity firm based in Park City, Utah. GVB also claims to have operations in Europe (location unidentified), and in Bogota, Colombia. GVB Biopharma joined Medicaleaf Ltd., Cheltenham, Gloucestershire, and Isomist Ltd., London to submit three products for FSA approval outside of its relationship with RX Pharmatech. GVB Biopharma is reported to be in a strategic relationship with Sonder Fulfillment, a division of Golden Triangle Ventures, a Las Vegas-based penny stock operator.

Associated principals: RX Pharmatech Ltd. – Dominic James Bartle, director; Damien Jonathan Bove, director. GVB Biopharma – Phillip Swindells, CEO & co-founder; Jack Feldman, president & co-founder; Hugh Kinsman, CFO.

Mile High Labs

Broomfield, Colorado-based Mile High Labs is a supplier of CBD, CBN, CBG and other cannabinoids. Mile High reported in 2019 that it has raised a total of $100 million in funding through two rounds, the latest on April 12, 2019, including $65 million in debt financing from MGG Investment Group, New York (2019). Mile High operates an extraction facility with raw materials sourced from a network of contracted CBD hemp growers in the USA. The company also has an office in Belfast, Northern Ireland, according to its website.

Associated principals: Jonathan Hilley, CEO; Ryan Keeler, COO; Jodi Gatica, VP quality; Danny Moses, investor.

Taylor Mammon Ltd

Taylor Mammon Ltd. identifies itself as a white-label manufacturer and CBD distributor based in Welwyn Garden City, Hertfordshire. The company operates under Kentucky, USA-based parent GenCanna, also known as OGGUSA Inc. GenCanna famously crashed in 2020, when it filed for bankruptcy amid a flurry of lawsuits from creditors who claimed at the time that the company owed them between $100-500 million. The bankruptcy court approved the sale of most of GenCanna’s assets in May 2020 to MGG Investment Group, New York, a private direct lender and one of GenCanna’s creditors. GenCanna purchased Taylor Mammon and UK-based CBD Capital last year.

Associated principals: Taylor Mammon – Alex Taylor, co-founder; James Taylor, chief commercial officer; Nathan Wogman, co-founder and managing director. GenCanna/OGGUSA Inc. – Andrew Barnett, CEO; Hassan Akhtar, managing director, Europe.

Sativa Wellness Group

Now known as Goodbody Health Inc, but having submitted its novel foods applications under Sativa Wellness, the Canada-based company is an OTC traded maker of roughly 20 CBD products – oils, capsules, gummies, and cosmetics sold online and through wholesale, and which has laboratories for testing CBD products in the UK and Poland. Headquartered in Vancouver, British Columbia, Goodbody/Sativa Wellness also has an office in Beckington, Somerset, England. The company recorded a loss of nearly $6.5 million (£5 million) in 2020, the last year for which public financial reports are available. Shares in Goodbody are currently trading at around $0.05 (5 cents). Goodbody’s UK subsidiary, PhytoVista Laboratories, was granted a controlled drugs license this month (April 2022).

Associated principals: (Goodbody Health Inc): Geremy Thomas, Founder & Executive Chairman; Marc Howells, CEO; Anne Tew, CFO and Corporate Secretary.