While Australia’s hemp industry faces significant challenges to development, political momentum is growing in some states and healthy investment levels are projected over the next two years in the fiber hemp subsector, according to the Australian Hemp Council (AHC).

Total Australian plantings more than doubled in the 2023-2024 season to reach 3,266 hectares compared to 1,493 hectares in 2022-2023. That reversed a three-year slide in overall plantings after fields peaked at 4,132 hectares in 2019-2020.

Fiber hemp plantings nearly doubled year-on-year, with fields expanding from 858 hectares last planting season to 1,564 hectares this year, according to a report by AHC President Tim Schmidt at the recently held Australian Industrial Hemp Conference.

Investment growing

AHC figures show that over the last three years, AU$52 (~US$34.4 million) has been invested into Australia’s fiber hemp industry, with an additional investment of AU$195 million (~US$129 million) expected over the next two years, according to Schmidt.

“Industry opportunities have become evident in how our fiber investment patterns have changed,” he said.

Conservative estimates in yield and pricing put Australia’s fiber industry at a value of AU$5.4 (US$3.6) million, according to Schmidt. With grain crops valued at AU$5 million (US$3.3), the total AU$10.4 million (US$6.9) exceeds earlier estimates made by Agrifutures Australia, the government agency that invests in farming research and development, which had projected it would take two years to reach that level. Australia now has 11 decorticating facilities compared to just two five years ago, Schmidt said.

With fiber fields expected to grow by an additional 2,000 hectares next season, that would push total planted area beyond 5,000 hectares and set a new all-time high-water mark, according to the report.

‘Choking CBD’

Meanwhile, grain production bounced back in 2023-2024, nearly tripling from 630 hectares the previous season to 1,700 hectares – equal to the level planted two years ago, the AHC report shows.

Australian hemp is limited to food and fiber outputs, as derivatives from the hemp flower are tightly restricted. While CBD is legal, it is confined to pharmacist-only medicine requiring prescriptions.

“The government is effectively choking CBD production in Australia,” Schmidt said. “We know that if growers were allowed to grow and process CBD on an open scale, we could have raw material product available at an extremely competitive rate, which has already been proven by New South Wales growers.”

NSW clear leader

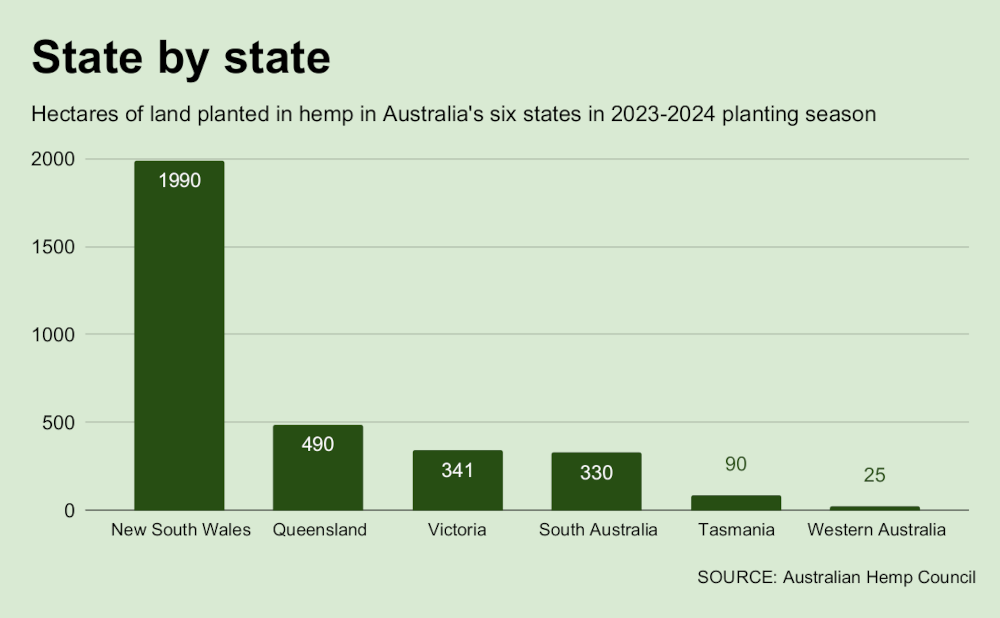

Australian hemp is led by New South Wales (NSW), which accounted for roughly two-thirds of the total hectares planted in 2023-2024, balanced between 970 hectares of fiber crops and 1,020 hectares planted for grain, to reach total fields of roughly 2,000 hectares.That peformance pushed the state to slightly beyond its previous peak of 1,900 hectares reached in the 2019-2020 season.

The NSW government “is the most supportive and proactive” among Australian states, reflected in recent regulatory changes that allow the extraction of non-medicinal elements from the hemp leaf, and the establishment of a task force to support the industry, Schmidt said.

Among developments in other states, according to the AHC report:

Queensland: Queensland suffers from “poor support for the industry,” with no dedicated hemp legislation, and hemp laws under the Drugs Misuse Act. While the AHC has been consulted by the Queensland premier’s office, political changes mean “we have not seen any encouraging signs of change.” To farm hemp in Queensland, growers must pay AU$1,500 for a hemp licencse and pay travel costs of AU$180 per hour to have crop samples collected.

Victoria: A bill that could create new opportunities for the state’s regional communities is now afloat in the Victorian parliament following an industry study. The proposed legislation would loosen regulations for hemp growers and unlock the potential for production of sustainable building materials and other products.

South Australia: “Significant” proposals are being pursued which include government support for the housing industry that look promising. Strong yields of up to two tons per hectare were recorded for grains this season.

Tasmania: Hemp fields have severely contracted to just 90 hectares from a high of 1,500 hectares at a peak in 2019-2020. The state government is allowing a pilot scheme that allows the use of hemp stubble as mulch in the horticultural industries, “a great step towards bringing hemp into mainstream applications and adding value for growers.”

Western Australia: The government “has let support for the industry fall away,” resulting in “growers and processors over there feeling abandoned by their government.” Unusually dry conditions also discouraged hemp growers from planting this past growing season

Call for unity

Australian hemp needs, first of all, more industry unity, according to Schmidt. Beyond that, increased government support, “massive capital investment,” research and techological advancements, standards for raw materials and finished products, and better integration of production, processing and markets are all challenges faced by the industry.

“It is no doubt a huge task to bring maximum value to our hemp industry . . . . It is a global struggle and the issues needed to be addressed are common throughout the world,” Schmidt said. “Whichever country can create the best environment for hemp industry development will be the one that will be the global leader.”