CBD maker Charlotte’s Web Holdings Inc. reported another quarterly loss as financial headwinds and industry challenges persist for the Louisville, Colorado-based company. In Q3 2024, the company recorded a net loss of $5.8 million, marking an improvement from the $15.2 million loss posted in Q3 2023.

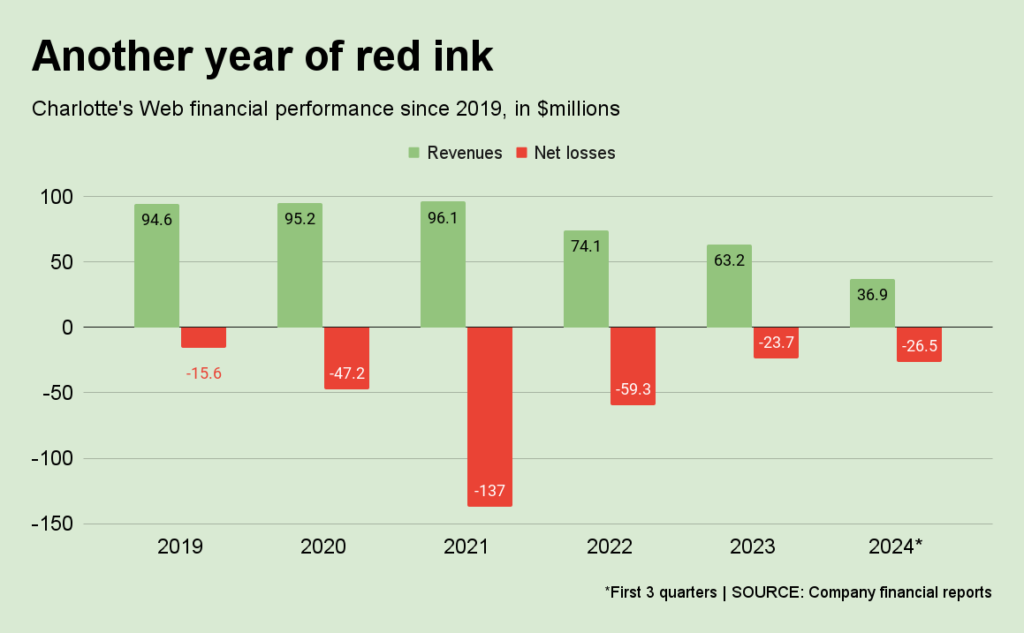

However, despite cost-cutting efforts, lower revenue and ongoing regulatory hurdles have kept the company in the red. The losses through three quarters this year are greater than the company suffered in all of 2023, when it shed $23.7 million, after losses of $59.3 million in 2022. Revenue last year fell by 14.8% to $63.2 million from $74.1 million in 2022.

The company’s consolidated net revenue for Q3 2024 was $12.6 million, down from $14.3 million in the same period in 2023, driven by decreased retail and e-commerce performance. Direct-to-consumer (DTC) revenue dropped by 13.4% year-over-year, reaching $8.2 million, while business-to-business (B2B) revenue fell 10.7% to $4.3 million. The lower revenue has negatively impacted the company’s gross profit, declining from $7.9 million in Q3 2023 to $6.7 million this quarter, reflecting a drop in gross margin from 55.5% to 53.0%.

Cost-cutting

Operating expenses saw significant reductions, with selling, general, and administrative (SG&A) expenses decreasing 36.2% from $19.9 million in Q3 2023 to $12.7 million in Q3 2024. The company credited this improvement to efforts made earlier in the year to streamline operations and reduce overhead.

Charlotte’s Web Chief Financial Officer Erika Lind noted that these measures aimed to lower cash burn and improve cost efficiency in the long term. Lind also highlighted that the company’s recent move to bring gummy production in-house is expected to boost efficiency and reduce production costs over time.

Despite a drop in operating expenses, Charlotte’s Web’s cash flow remains a concern. The company reported $7.6 million in cash used for operations this quarter, slightly lower than the $7.8 million in Q3 2023.

Capital expenditures for Q3 totaled $0.3 million, focused on upgrading in-house manufacturing for gummy and topical products. Charlotte’s Web’s cash position stood at $24.6 million as of Sept. 30, 2024, down from $47.8 million at the end of 2023.

Regulatory impact

Charlotte’s Web, like many CBD companies, has struggled against regulatory uncertainties and an industry-wide slowdown in consumer demand. Regulatory ambiguity surrounding CBD products continues to hinder growth in the U.S. market, affecting both consumer interest and retail support.

With limited federal guidance, the company faces challenges in retaining shelf space in retail stores, and market dynamics have shifted towards lower-priced products, putting additional pressure on revenues.