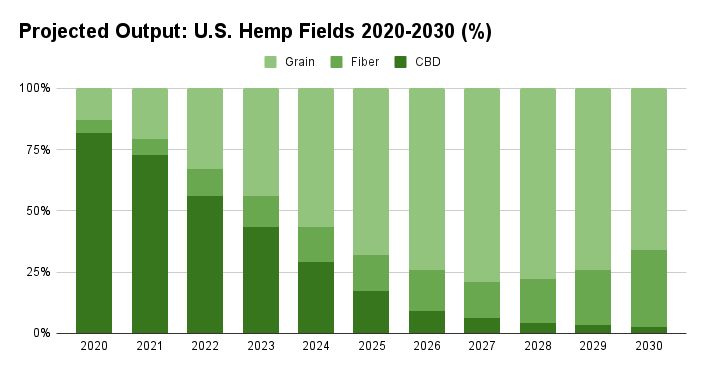

Acres licensed for CBD hemp will fall to just 2.78% of total U.S. fields while hemp grown for seed production will be the dominant output one decade from now, according to estimates in a report from the National Industrial Hemp Council (NIHC).

With CBD this year having been grown on 82% of total licensed U.S. hemp acres, NIHC expects seed production will rise to 65.8% of total acreage while that dedicated to processing of the hemp stalk will reach 31.4% by 2030.

Those totals will come as hemp expands robustly in the United States to meet growing demand, and becomes a major commodity with farm-gate sales surpassing $10 billion a year by 2025, NIHC projects in the report, released last week.

‘Dramatic rise’

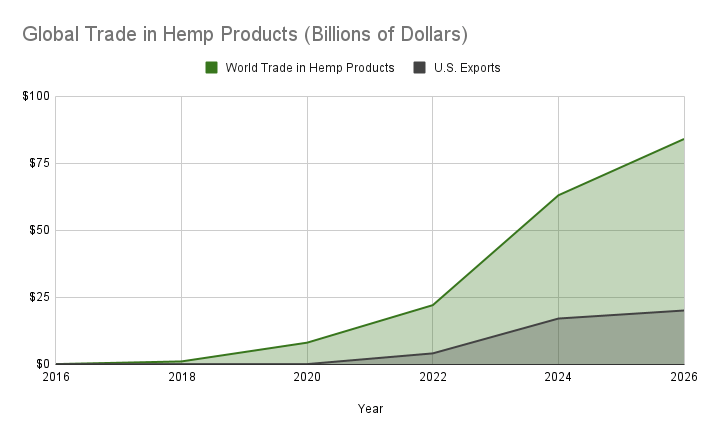

“Export Market Development: U.S. Industrial Hemp’s United Front” looks at the U.S. hemp industry in the context of global markets, estimating that U.S. exports of hemp and hemp derivative products exceeded $1.8 billion in 2020, up from $310 million in 2019.

“Despite the challenges of the pandemic and regulatory uncertainty in both the U.S and abroad, demand for hemp fibers, grain and oil continues its dramatic rise,” the report notes. “Given the proper regulatory framework and market support, industrial hemp will provide U.S. farmers with another sustainable and profitable crop for the long-term.”

NIHC said intermediate processing and downstream production can help improve farm profitability and boost rural economies, providing market incentives for expansion of hemp production.

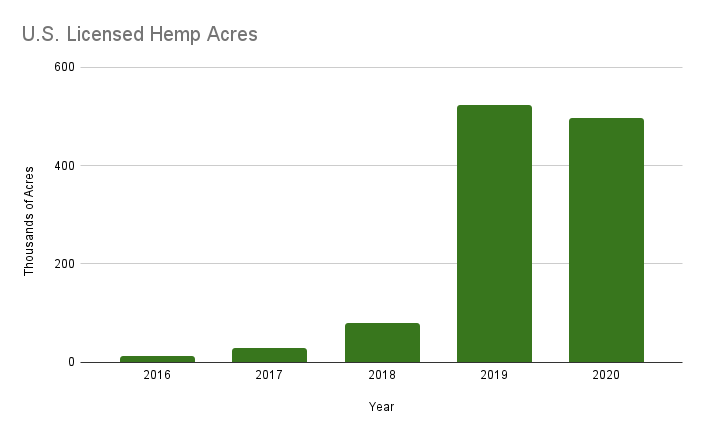

Among other indicators, NIHC reported that licensed hemp fields in the USA last year totaled 465,787 acres. While that figure is down from 511,442 acres in 2019, it is nonetheless nearly four times the acreage licensed in 2018, the report notes. Meanwhile, the number of licensed growers surpassed 21,000 last year, up from 16,877 in 2019, NIHC said.

$8.1 billion in global trade

On a global scale, “trade in industrial hemp and hemp-based products was over $8.1 billion in 2020 and is forecast to be more than $65 billion by 2026,” the report states.

NIHC said delayed guidance from the U.S Food & Drug Administration regarding CBD’s treatment in the food supplement and nutraceutical markets is a key hangup.

“The delay has resulted is ambiguity with respect to how these products are regulated and difficulty establishing international standards, even while the domestic market for these products has flourished,” the report observes.

International standards needed

Harmonization of international standards and certifications are a critical areas for international engagement, NIHC said, noting it has observed “developing local trade centers that restrict international trade.”

“For example, in Europe trade in raw hemp and raw hemp fiber is two times the international trade. In other words, intra-European trade has exploded, while at the same time U.S. exporters find a challenging market because of ambiguous import requirements and inconsistent implementation by its member states,” the report notes. In China, recent regulatory changes increasingly limit U.S. export opportunities to hemp fiber, NIHC also said.

READ: Export Market Development: US Industrial Hemp’s United Front