Founders of leading U.S. CBD maker Charlotte’s Web have called for changes at the top by seeking resignations from four of six current directors, including board President John Held and the company’s CEO, Jacques Tortoroli.

In a scathing press statement released Monday, founding brothers Joel and Jesse Stanley said strategic missteps, uncontrolled spending and poor hiring practices have put the Denver-based company “at risk.”

“The incumbent Board and management’s business strategy has been to pin their hopes on FDA regulations changing in favor of the business,” the brothers said in the statement. “Rather than innovate within the current framework, the Company continues to burn money on conventional marketing.”

Ahead of the company’s annual general meeting scheduled for this Thursday, the Stanleys urged fellow shareholders to withhold votes for Held, Tortoroli and independent directors Thomas Lardieri and Alicia Morga. The Stanleys apparently have no beef with Susan Vogt and Jonathan Atwood, two other directors who would presumably continue on the board.

‘Exorbitant compensation’

The brothers criticized the company’s leadership for changing the CFO four times in the past two years, and for paying “exorbitant compensation to the CEO and other senior executives,” and said “management has not been held accountable by the Board for chasing acquisitions and distributor and marketing relationships but repeatedly failing to successfully execute on these transactions.”

Joel Stanley said the four directors targeted for dismissal “will fail to achieve majority support,” and should “do the right thing by stepping down and avoid delaying change.” The Stanleys urged the four be replaced by themselves and Lynn Kehler, a business and finance executive, and natural products industry veteran Angela McElwee.

According to the Stanleys’ press release, Major League Baseball (MLB), a strategic shareholder in Charlotte’s Web, agrees that the changes are needed. The company last year struck a landmark exclusive marketing deal that gave the league 4% of the company’s shares, and committed to pay MLB $30.5 million plus a 10% royalty on sales. Analysts said at the time that the deal, which runs to 2025, won’t mean significant additional revenues for the company.

Where’s the bottom?

The proposed shakeup at Charlotte’s Web comes as publicly traded CBD companies continue in the doldrums, with shrunken margins, soft sales and regulatory uncertainty driving the sector to the bottom, wherever that may be.

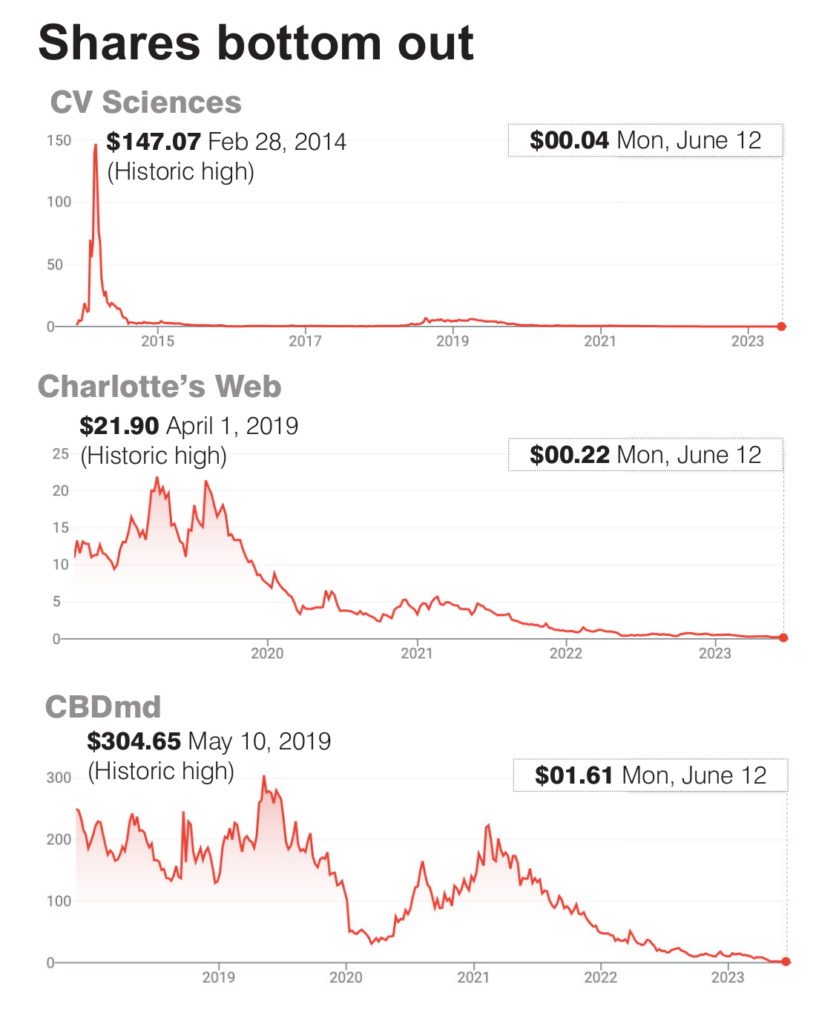

Charlotte’s Web shares closed Monday, June 12 at $0.2196 (about 22 cents) against the stock’s all-time high of $21.90 reached April 1, 2019. The company went public in September 2018 on the Toronto Stock Exchange and the OTCQX Venture Market in the U.S. – risky “penny stock” or “small cap” markets that are highly volatile.

Charlotte’s Web had a net loss of $59.3 million on revenues of $74.1 million last year, according to its year-end financial statement.

Burning cash

The Stanleys say losses have totaled $186 million in the 24 months ending March 31, 2023 as the company suffered “a steady decline in revenue across all channels, with little to no product innovation or SKU expansion.”

“The significant cash burn rate with decreasing revenues must end immediately,” said Jesse Stanley.

In its Q1 2023 Report, Charlotte’s Web blamed its downward slide on decreasing demand for CBD tincture in the business-to-business and direct-to-consumer markets as customers turn to lower-priced gummies and topical products, and focused on its progress in cost-cutting. “We maintained prudent cost controls to balance softness in the CBD category,” the company said, noting it reduced operating expenses by 14% on a year-on-year basis, from $20.4 million in Q1 2022 to $17.5 million in Q1 2023.

Widespread suffering

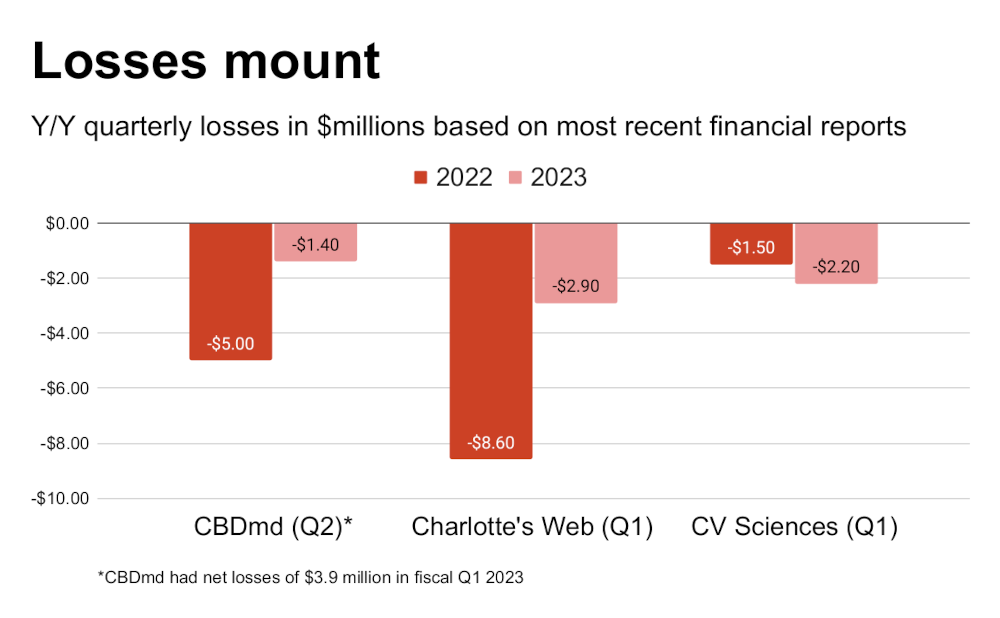

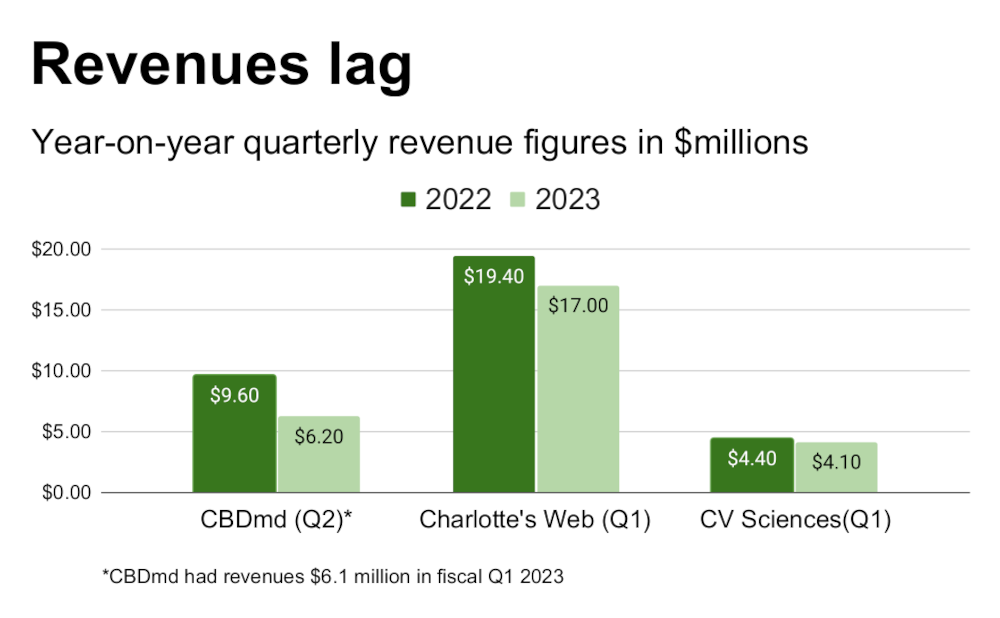

A HempToday review of quarterly reports showed that Charlotte’s Web, CBDmd and CV Sciences – all of which produce CBD products exclusively – recorded combined quarterly losses of roughly $7 million at the beginning of 2023. That was an overall improvement compared to combined losses of $15 million in analog quarters for 2022, but the gains have come strictly from trimming costs.

All three also suffered revenue declines compared to income in the same quarter last year.

Meanwhile share prices of the companies remain volatile, with most of the stocks drastically down from historic highs.

CBDmd’s share triage

Charlotte, North Carolina-based CBDmd said it achieved savings of $24 million in operating costs year-on-year year in fiscal Q2 2023. The company’s struggles were illustrated in April when the CBDmd board of directors approved a one-for-45 reverse stock split, effectively cutting the value of its shares by roughly 98% while consolidating its 65.5 million shares to approximately 1.45 million. CBDmd’s net losses in 2022 were $70 million against revenues of $35 million.

CV Sciences reported units sold during the quarter were down 13%, and said it has a “plan to continue participating in the consolidation and brand contraction of the CBD market.” The San Diego-based company said its first-quarter gross margins exceeded expectations and that it is “encouraged by improvements we have made to reduce operating expense.” Net losses for CV Sciences in 2022 totaled $8.2 million as the company brought in revenues of $16.2 million.

In a May 15 regulatory filing with the Securities and Exchange Commission, CV Sciences stated: “Due to a low barrier entry market with a lack of a clear regulatory framework, we face intense competition from both licensed and illicit market operators that may also sell plant-based dietary supplements and hemp-based CBD consumer products.”

Cronos departs U.S.

Also indicating struggles for CBD in the U.S., Toronto-based Cronos Group, which is in both the marijuana and CBD business, reported losses of $19.3 million in Q1 2023, and the company announced last week its intentions to withdraw from the American CBD market. The Q1 2023 losses come after Cronos took a $168.7 million hit during its last full fiscal year.

In announcing its departure from the U.S., Cronos is essentially giving up on a $300 million investment it made in 2019 when it bought four CBD subsidiaries of Redwood Holding Group. The company has now retreated to the Canadian CBD market, where its CBD business generates only about $1 million in revenues, less than one percent of the company’s total income, which is overwhelmingly from marijuana. Cronos now says it is “laser-focused on becoming cash-flow positive by driving cost savings and process efficiencies” as it concentrates on its marijuana products.

Cronos said the shutdown of its CBD operations in the U.S. will result in charges of up to $1.8 million in the current quarter. The company also said it increased its 2023 cost-cutting goal to $20-$25 million, up from $10 million to $20 million previously planned for the current year.

Existential questions

In addition to weakened demand and the massive oversupply of hemp flowers needed to produce CBD, which brought prices plunging to earth beginning in 2019, the sector faces considerable other challenges.

CBD makers have complained for five years that a lack of regulations is holding the industry back. While rules may be coming, it doesn’t appear that will be anytime soon. When they do come, CBD stakeholders may get more than they wish for, as the U.S. Food & Drug Administration (FDA) has given signals that it could assign CBD to a drug category, which would wipe out the market as it now exists.

Driven by a safety-first ethos, FDA has repeatedly expressed concerns about CBD’s potential effects on the liver and male reproductive system, worries over adverse interactions with certain medications, and fears over exposure to young children, pregnant women and fetuses, and the elderly. The FDA in late April released a “Review of the oral toxicity of cannabidiol (CBD),” an ominous 40-page paper based on a compilation of existing clinical studies, underscoring those safety concerns.