U.S. hemp fields are expected to reach 50,000 acres by 2028 as production expands at a rate of 34% per year and processing infrastructure continues to expand, according to projections from Denver-based analyst PanXchange.

That means the projected value of decorticator capacity in the U.S. will gradually rise to reach about $2.3 billion by 2027, PanXchange projected.

Broad analysis

The forecast comes in a newly released report, “U.S. Industrial Hemp Fiber: Processor Capacity and Margins,” which provides a detailed overview of the current state of the U.S. hemp fiber sector as well as projections for the next five years. The report analyzes U.S. supply; demand; the national and regional landscape; demand drivers; current raw materials pricing; processor capacity and future marketing expectations.

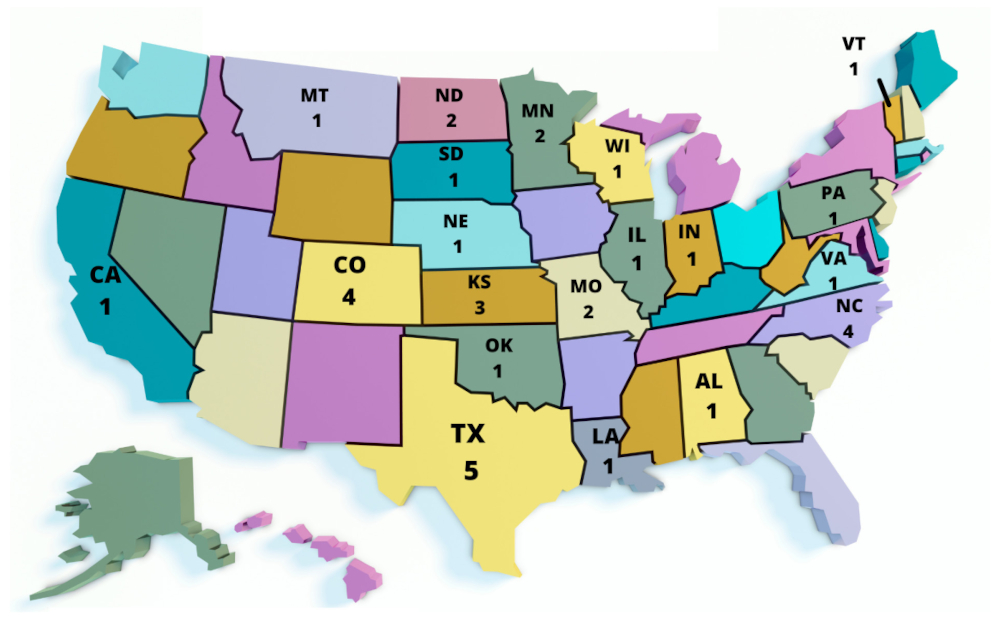

PanXchange reported that 20 U.S. hemp fiber processing plants are now operating and capable of the initial processing or decorticating hemp biomass, and six exist in Canada. An additional 8-to-12 are expected to start production in the U.S. by 2028.

“Over the next five years, hemp processing capacity will be limited by regional U.S. acreage,” PanXchange observed.

Farming outlook

Income from hemp grown for fiber reached peaked at $41.4 million in 2021, according to the USDA. And estimates from the National Industrial Hemp Council of America are that fields dedicated to processing of the hemp stalk will eventually reach roughly 30% of all hemp harvested by 2030.

PanXchange projected in October that the 2022 fiber harvest would come from just 8,200-9,100 acres, but account for more than 43% of all hemp harvested in the U.S. last year. That was a drop of 30% from the roughly 12,700 acres harvested in 2021, as reported by the National Agricultural Statistical Service in a first-ever USDA report on hemp. That report recorded the total value of hemp harvested in the USA last year at $824 million.