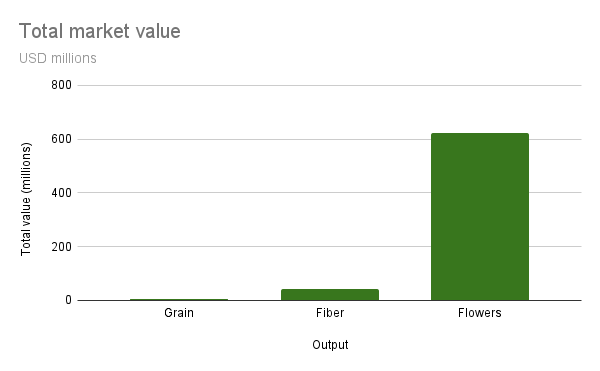

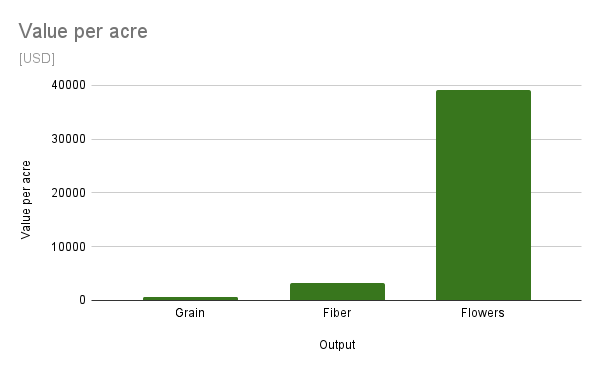

The total value of hemp harvested in the USA last year was $824 million, led by flower production, which brought roughly $735 million from outdoor and indoor growing combined, according to figures reported by producers to the U.S. Department of Agriculture (USDA) for the first time.

Income from flowers dwarfed that from fiber and grain, with values for those outputs reported at $41.4 million and $5.99 million, respectively, according to USDA’s inaugural National Hemp Report released yesterday.

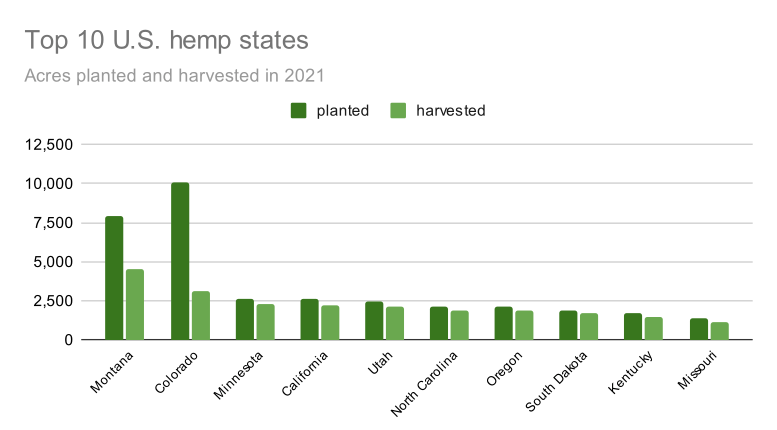

U.S. farmers harvested 33,500 acres of hemp after planting a total of 54,000 in spring 2021, USDA reported. Montana led all states with 4,500 acres harvested, followed by 3,100 acres in Colorado; roughly 70% of hemp fields planted in Colorado were apparently not harvested last year, according to figures in the report.

20,000 producers queried

The USDA survey, sent out last October to more than 20,000 hemp producers across the nation, was returned by about 65%, USDA reported.

“The release of this landmark report provides a needed benchmark about hemp production to assist producers, regulatory agencies, state governments, processors, and other key industry entities,” Hubert Hamer, Administrator at USDA’s National Agricultural Statistics Service (NASS), said in a news release.

“Not only will these data guide USDA agencies in their support of domestic hemp production; the results can also help inform producers’ decisions about growing, harvesting, and selling hemp as well as the type of hemp they decide to produce. The survey results may also impact policy decisions about the hemp industry,” Hamer said.

Difficult to compare

While no consistent analog data exists for comparison, it’s clear that hemp production has fallen precipitously after peaking during the 2017-2019 boom days in the CBD sector.

Earlier estimates for 2021 by hemp tracker Hemp Benchmarks suggested 110,000 acres were licensed both outdoors and indoors (3,800 acres) in 2021, a drastic drop from two years previous when the data provider estimated licensed acres at 580,000 acres.

But as USDA’s figures suggest, licensed and planted hemp acres do not reflect total area harvested. If the USDA’s figures, which included reports from nearly all 50 states, are accurate, that would mean only half of all the licensed area for hemp counted by Hemp Benchmarks was actually planted, and only 30% of that planted was harvested.

Data in the National Hemp Report was collected by NASS under authority of the Domestic Hemp Production Program, which is managed by the USDA’s Agricultural Marketing Service. The research, which is to be ongoing, was shaped by a number of federal agencies.

Another study coming

USDA is meanwhile working on a separate national survey among 18,000 hemp businesses regarding production practices and costs, and marketing of hemp products, in partnership with the National Association of State Departments of Agriculture and the University of Kentucky.

That survey is currently gathering data on production location, licensed acreage, planted acreage and harvested acreage by end-use. It also embraces issues related to seeds, fertilizer, licensing fees, labor, farm-gate prices by end use, and a number of matters related to contracts.

For that survey, NASS is querying 36,000 producers from various agriculture segments for responses to support market projections. The farming census, carried out every five years, looks at a wide range of indicators to guide policymaking.

Food expected to rise

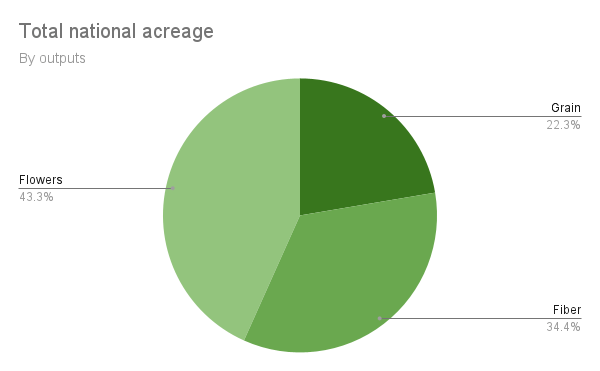

Over the long term, acres for hemp flowers, the source for CBD, are expected to be dwarfed by those dedicated to fiber and grain. In a report from last summer, the National Industrial Hemp Council of America (NIHC) projected CBD-hemp fields will shrink to just 2.78% of total U.S. acreage over the next decade, with hemp sown for seed production growing to become the dominant output.

NIHC expects grain production will rise to 65.8% of total acreage while that dedicated to processing of the hemp stalk will reach 31.4% by 2030.

Those totals will come as hemp expands robustly in the United States to meet growing demand, and becomes a major commodity with farm-gate sales surpassing $10 billion a year by 2025, NIHC projected.

USA hemp: Key indicators

See the full USDA National Hemp Report