Income from hemp flowers bounced back slightly last year while fiber growers saw the value of their outputs fall sharply even though total fiber fields expanded, according to the third annual hemp report from the U.S. Department of Agriculture (USDA).

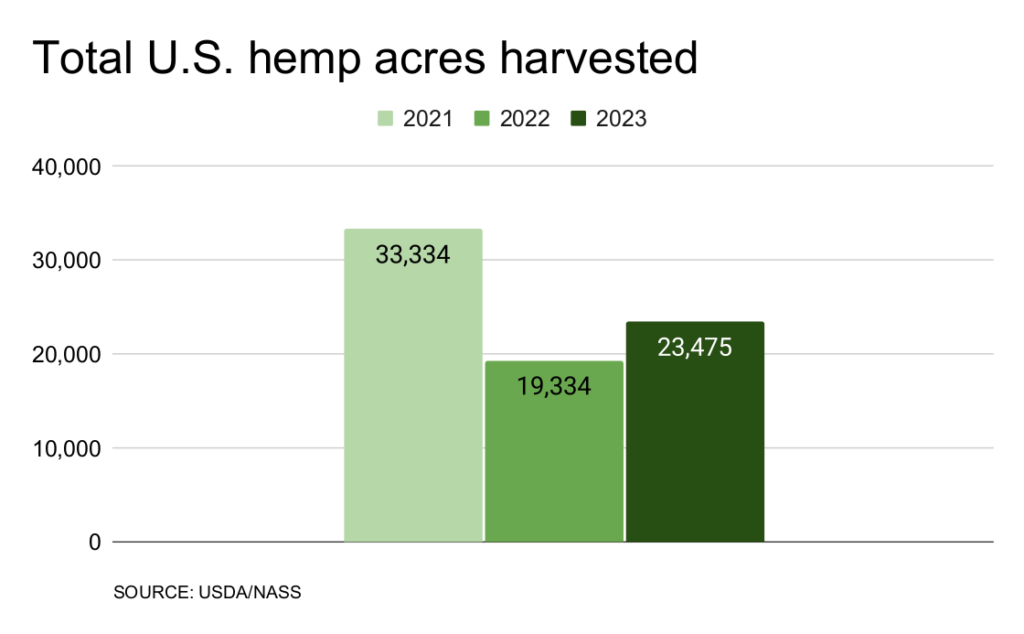

Overall, the highly anticipated report gave hemp stakeholders little to cheer about, with fields still well down from a peak of 37,000 acres in 2020, according to estimates from non-USDA sources at the time. That’s when a rush to CBD extracts led to a crash that left farmers and investors burned as the biomass needed for production went unsold across the country, and prices plunged by as much as 90%.

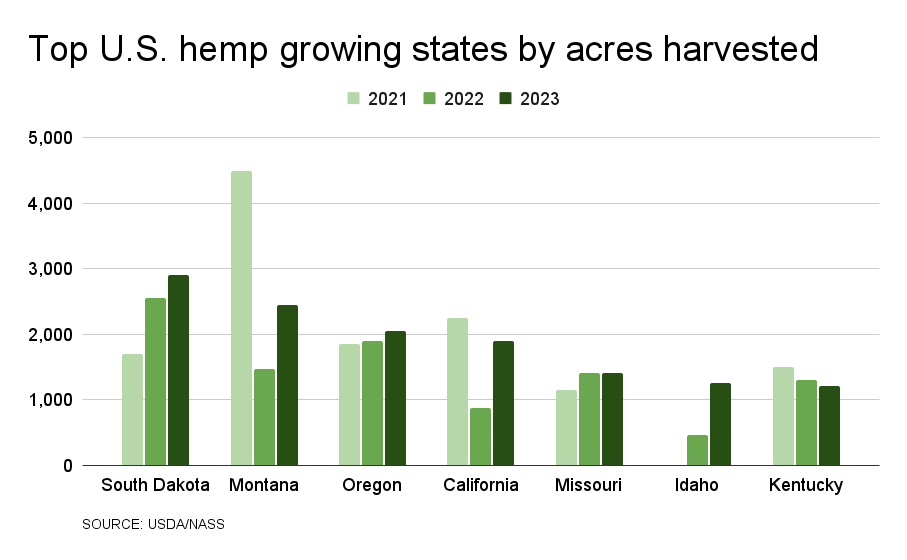

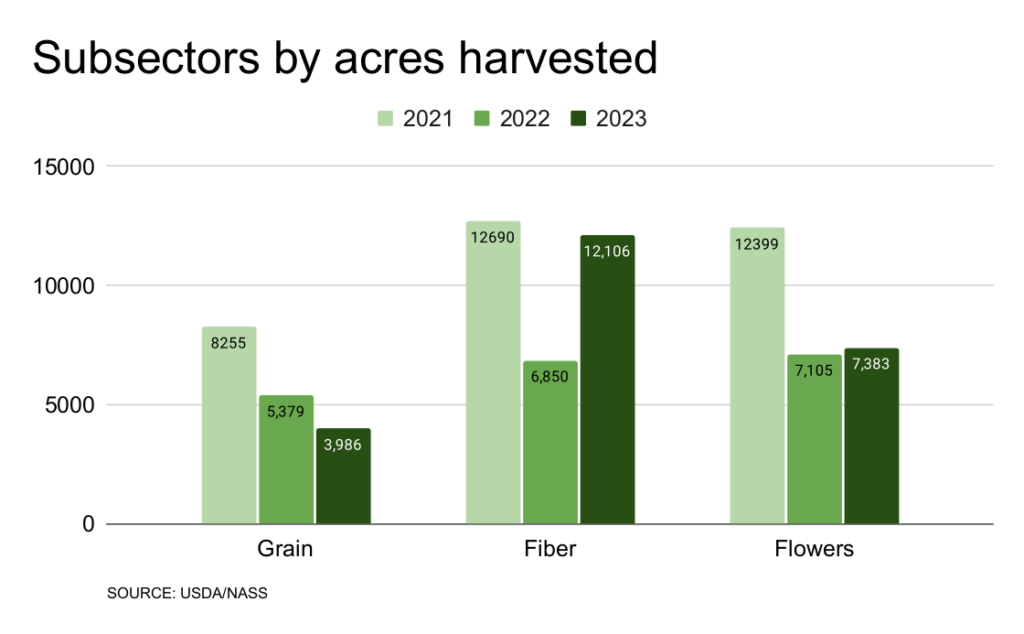

In terms of acreage, industrial hemp farming grew modestly in the U.S. in 2023 after years of decline, with growers harvesting 23,475 acres compared to 18,251 acres in 2022, the USDA report shows.

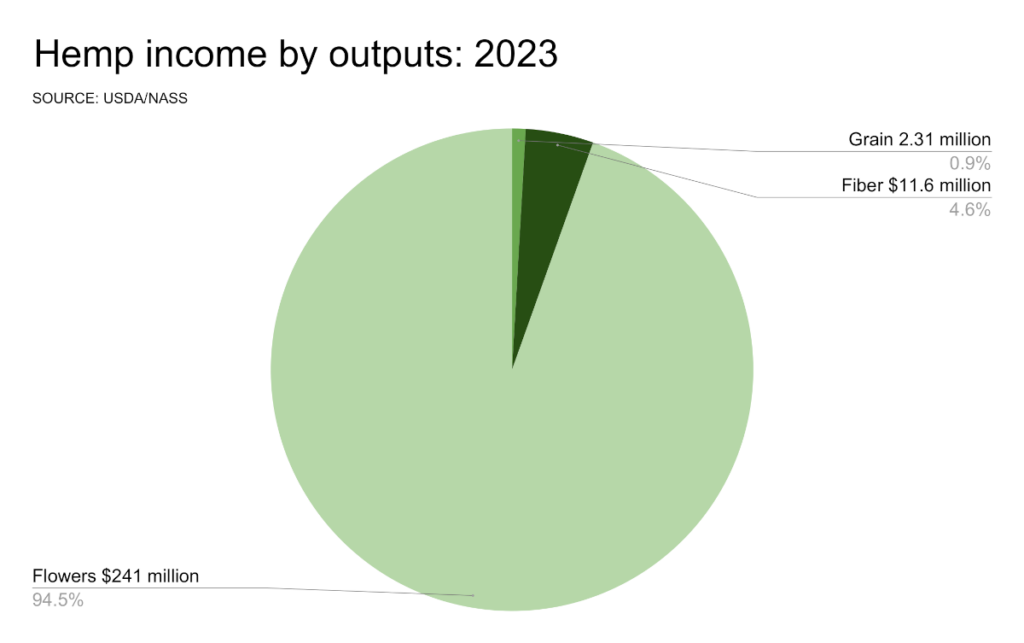

But while the total value of hemp increased to $258 million in the USA last year from $238 million in 2022, the gain was attributable exclusively to a flower subsector in which growth cannot be expected to hold up long-term. Overall, income from hemp flowers dwarfed fiber and grain, accounting for $241 million of the 2023 total.

Flowers: Acres flat, $$ grows

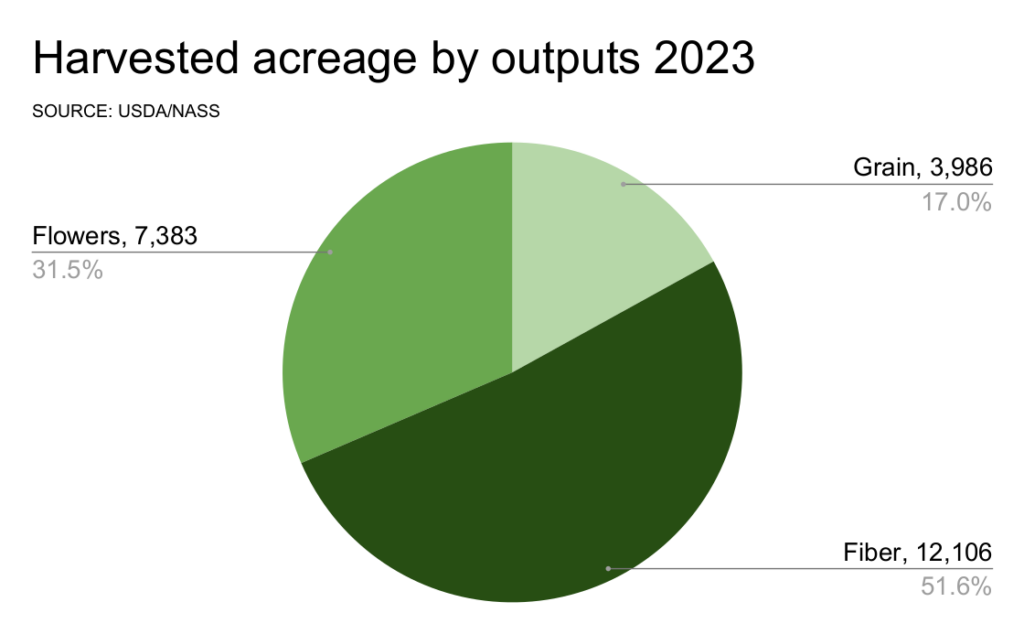

While flower acreage remained flat at about 7,000 acres in 2023, flower growers saw an overall income gain of 35%. The $241 million in income from hemp flowers in 2023 compared to $178 million the year previous.

But those gains are likely unsustainable beginning in the near future as a gray-market boom in intoxicating hemp products – mostly made from CBD derived from the plant tops – can be expected to subside. That’s because more and more states are reining in the products, which proliferated as a result of a loophole in the 2018 Farm Bill, which legalized hemp federally.

In drafting that measure, lawmakers failed to see the emergence of edible, psychoactive products containing delta-8 and other synthetic forms of THC that can be made from hemp. The popular products, most of which are produced in the lab from hemp-derived CBD, are sold as alternatives to marijuana, which contains high concentrations of delta-9 THC.

In addition to bans instituted by individual states, separate federal legislation could be forthcoming that could restrict products containing the synthetic hemp-derived intoxicants to regulations for recreational or medical marijuana, severely limiting the markets as such products are now widely available in common retail outlets throughout the country. Also, U.S. lawmakers could conceivably ban the products altogether, as some states have done.

Fiber: Acres grow, $$ shrinks

While hemp flowers grew in value, hemp fiber went in the opposite direction, according to the report. Fiber acres grew 77% to reach 12,106, but the subsector saw the cash value of its output fall 59% – from $28.3 million in 2022 to just $11.6 million in 2023 – indicating significant price drops.

Meanwhile, U.S. hemp farmers appear to be content to let Canada continue to dominate the U.S. markets for foods based on hemp grain. U.S. grain fields fell to just 3,986 acres in 2023, down from 5,379 acres in 2022. The value of grain fell from $3.63 million in 2022 to $2.31 million in 2023, shedding 36%, the NASS report shows.

In a minor bright spot, 2023 production of hemp cultivation seed was estimated at 751,000 pounds, up 414 percent from 2022 as growers harvested 1,344 acres, up 66 percent from 2022. The value of hemp grown for seed totaled $2.91 million, up 96 percent from 2022.

The hemp figures were collected by NASS under authority of the Domestic Hemp Production Program, which is managed by the USDA’s Agricultural Marketing Service. The research is shaped by a number of federal agencies.