[Last of three parts]

Despite the cloud that has descended over U.S. Hemp, a dwindled number of hearty survivors are sticking around, turning their attention to the promise of fiber in the textiles, construction, bioplastics and other industries, and grain for food and seed-oil-based personal care products.

But opportunities in those sectors don’t offer nearly the get-rich-quick promise of CBD that led to a massive oversupply of hemp flowers – and failure for many market participants – over the last three years.

PREVIOUSLY IN THIS SERIES

Part 1: With CBD gold rush over, U.S. Hemp is but a shadow of its former self

Part 2: Charlatans, bureaucracy, and mismanagement brought U.S. Hemp down to earth

The hard truth is that hemp is certain to be on a slow-growth path over the next decade, languishing under “specialty crop” status (think fruits and vegetables, tree nuts, tulips!). Investment will be hard to come by, and the competition from vested interests across the whole industrial spectrum will be difficult to challenge.

Still, considering the myriad opportunities of the plant to usher in a more healthy, climate-friendly world, the proven benefits of hemp are hard to ignore in the long term.

Build with it!

From a macro point of view, hemp’s greatest potential going forward is in construction, the 12th-biggest industrial sector in the USA, and the second biggest worldwide.

Amid the growing emphasis on everything “green,” hemp fiber is the perfect raw material for sustainable – and healthy – buildings.

But challenging even the existing “green building” sector, defined primarily by fancy ventilation systems and “smart” energy gee-gaws, won’t be easy. That’s not to mention entrenched construction interests based on traditional, polluting – often toxic – building materials. Those incumbent players won’t welcome hemp’s incursion into their well-established businesses.

Add in the layers of bureaucracy – federal, state and local building codes, materials standards, insurance, financing and zoning considerations, and the need to develop expensive processing infrastructure, training and public relations, and the challenges to hemp building are substantial.

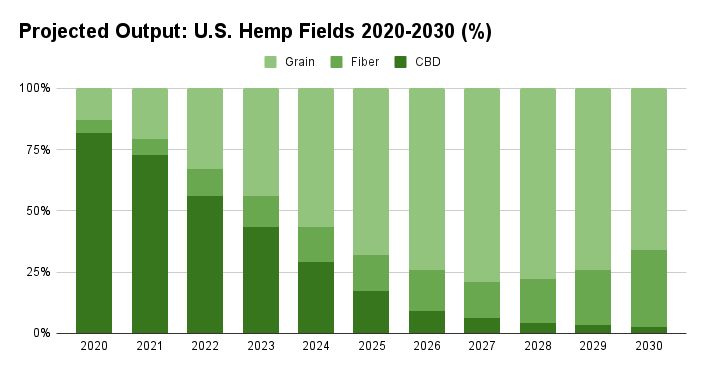

Income from hemp grown for fiber reached $41.4 million in 2021, according to the U.S. Department of Agriculture. And estimates are that fields dedicated to processing of the hemp stalk will eventually reach roughly 30% of all hemp harvested by 2030 (see chart), but the question is: How much total hemp will be grown for hurd and bast fibers, and how will demand play out for hemp-based sustainable wall construction and insulation.

The potential in seed

In the rush to CBD, U.S. hemp stakeholders essentially ignored grain, one of the most promising of hemp derivatives. Little movement in hemp seed is evident since the 2018 Farm Bill opened the market. That has left stakeholders more than 20 years behind experienced Canadian growers and producers, which have dominated the U.S. market since the turn of the century. According to the U.S. Department of Agriculture (USDA) hemp grain brought U.S. farmers just $5.99 million in 2021.

As consumers slowly turn to more healthy food, researchers and developers continue to explore the hemp seed for all its potential benefits to both humans and animals.

Hemp seed is finding a place among “superfoods” and in the growing protein powder niche, for example. It’s showing up in plant-based “meats” and snacks. Even the hulls are being explored for valuable ingredients.

Similarly, natural personal care products derived from or containing hempseed oil offer a growing array of therapeutic properties as studies consistently demonstrate its efficacy in such products as face cremes, moisturizers, soap, and shampoos & conditioners (many also containing CBD and other minor cannabinoids).

In both cases, however, natural-ingredient product categories are long dominated by established players and products based on alternative plant derivatives. Hemp food and hemp-based health & beauty products will find the slogging tough against incumbents in these sectors, which are niches in highly competitive sectors at large.

Some big producers in both food and personal care products have dabbled in hemp. But until such time as they take hemp derivatives up on a broader basis, and markets prove themselves, hemp-based formulations will be but a small sliver on the market-share pie charts.

Textiles: Design & promote

In addition to their application to the construction industry, hemp bast fibers have a following among the small number of U.S. natural textile enthusiasts. But will giant textile mills go back online in the USA? That’s highly unlikely.

First, the investment requirements are astronomical. Moreover, the forces that brought down U.S. textile processing in the first place still exist – namely production in lower-cost nations such as China, India and Pakistan, all of which are recognizing hemp’s potential in the apparel sector and still have industrial-scale mills running.

Major players have also dabbled in bast fiber-based non-woven materials, which could prove to be the first big play. But the chicken-and-egg nature of introducing a new raw material into this sector also indicates hemp will be slow to carve out any significant space anytime soon.

In the long term, the U.S. hemp textile market would do best to concentrate on fashion design and professional marketing, both of which are woefully lacking.

Challenges for plastics

As manufacturing industries give a growing amount of lip service to more sustainable, safe raw materials for production, fast-growing hemp is an excellent alternative to petroleum-based plastics and other polluting composites.

Bio-plastics made from non-toxic, biodegradable hemp fibers include standard plastics reinforced with hemp fibers to 100% hemp plastic and result in materials that have tensile strength greater than polypropylene, and are stiffer and more durable than the traditional plastics.

European automakers have famously started using hemp composites in door panels and interior car parts, favoring the material for its light weight, resistance to wear and tear, and flexibility. But this application is little more than experimental as yet.

While proponents tout the environmental benefits of hemp plastics, biodegradability depends on raw materials inputs. Products made from low-quality inputs mean such materials remain longer than expected in the environment, with the risk that they become pollutants. That means such bioplastics require special recycling facilities, and attendant costs.

Most challenging, the relatively high cost of hemp raw materials is a serious deterrent that can’t be overcome until scale is reached through massive investments, unlikely to come for many years. Consequently, operators in this space have struggled, and found financial support hard to come by.

CBD: Sticking around

Despite the sector’s missteps, CBD is a real thing with real benefits and a real market that won’t go away, however downsized it may now be.

As the hype about a soaring CBD market subsides, greatly reduced estimates hold that the sector will expand by 15-20% per year to reach roughly $17 billion in 2030. That’s healthy growth in a normal world. Applications and products will multiply. A reliable supply chain will develop. The market will stabilize.

But don’t expect any of this to happen soon.

CBD products will continue to be held back by a skeptical and slow-moving U.S. Food & Drug Administration (FDA), and continuing misunderstanding and general confusion among state governments and health officials. The specter of the U.S. Drug Enforcement Administration (DEA), a frequent meddler in hemp, also looms.

Desperation & delta-8

In their desperation, some CBD makers continue to push delta-8 THC, a synthetic form of the companion compound delta-9 THC produced from marijuana plants, as an outlet for hemp flowers. But delta-8 proponents are on thin ice in their narrow interpretation of the federal government’s hemp provisions in the 2018 Farm Bill, arguing that if hemp, the source material for delta-8 products, is legal, so should be downstream products.

States all over the USA are grappling with delta-8, which is unregulated by the DEA and therefore exists in a legal gray area. Some states have outlawed the compound altogether while others are treating it under rules for marijuana products. Regulators and even some hemp stakeholders say the Farm Bill never intended hemp to be used for products that can be classified as psychoactive, and oppose delta-8 THC because is not derived from the hemp plant in a natural manner.

As courts begin to weigh in on delta-8, it’s not surprising that proponents cheered a recent U.S. appeals court decision suggesting Congress likely did not intend to impose a rule that hemp be produced exclusively for industrial purposes. But that ruling, legally strict in nature, is unlikely to cause federal agencies to change their approach to hemp. Indeed, in the lobbying efforts that brought hemp back as a legal crop, many hemp advocates implied the promise that it specifically would not be used for such purposes.

At best, this milder form of THC is destined to find its place alongside delta-9 THC products, in regulated marijuana dispensaries. Even then, a real market won’t develop until the government removes marijuana and THC products altogether from its Schedule 1 controlled substances list – which looks unlikely anytime soon.

At worst, the DEA will continue to stick its nose into things. The agency has already specified that only forms of THC that are naturally occurring in hemp are legal.

In short, the delta-8 niche will offer little serious growth potential in the immediate future.

Other promises

Of course, the holy grail everyone talks about in hemp is in multi-cropping, a more difficult proposition than most imagine. While the idea of turning out both seed and fiber may sound nice, those plant components mature at different rates, meaning there’s always a trade-off in volume or quality. And to maximize dual-crop outputs, expensive technology is still needed.

Investments for large-scale production can be huge and run into the classic chicken-and-egg, supply-and-demand conundrum.

Meanwhile, the hype is already underway over hemp’s potential role in carbon. But the infrastructure for trading carbon credits is especially weak in the U.S. So despite hemp’s promise to help clean up the planet, real profits from farming hemp – for carbon credits in addition to its many promising practical applications – appear to be at least five years away.

Starting all over

Unsurpassed in its ability to help clean the air we breathe, good for the soil, healthy and nutritious, industrial hemp offers significant promise to heal the sick environment and provide food and shelter desperately needed in many parts of the world.

But for at least the next decade, you can forget about the hyped-up dream in which hemp competes with major commodities such as corn and soybeans.

To develop the most promising applications, U.S. Hemp needs a re-start. And it won’t be like it was before. After the mad rush to CBD and the attendant fallout, the challenges will prove to be staggering. Most critically, money will be scarce.

As hemp in the United States hits the re-set button, stakeholders need to stop talking to themselves at insular hemp-can-save-the-world gabfests, engage serious lobbyists to advance constructive regulations, and enlist professional marketers to address each sector where the plant holds promise. Absent that paradigm shift, the hemp industries and the investment needed for development will be slow to materialize.

And they would be wise to take heed of an oft-repeated axiom from Daniel Kruse, President of the European Industrial Hemp Association and a 25-year hemp veteran active across a wide range of hemp sectors: “To make a small fortune with hemp, you have to start with a large fortune. And then hold out for a long time to finally increase that original fortune.”