The UK’s All-Party Parliamentary Group (APPG) on CBD Products has taken direct aim at its foot, and fired off a few additional wild shots on industrial hemp in a grandiose plan to capitalize on a “once-in-a-generation opportunity” and “establish itself as a leader in the emerging global cannabis industry.”

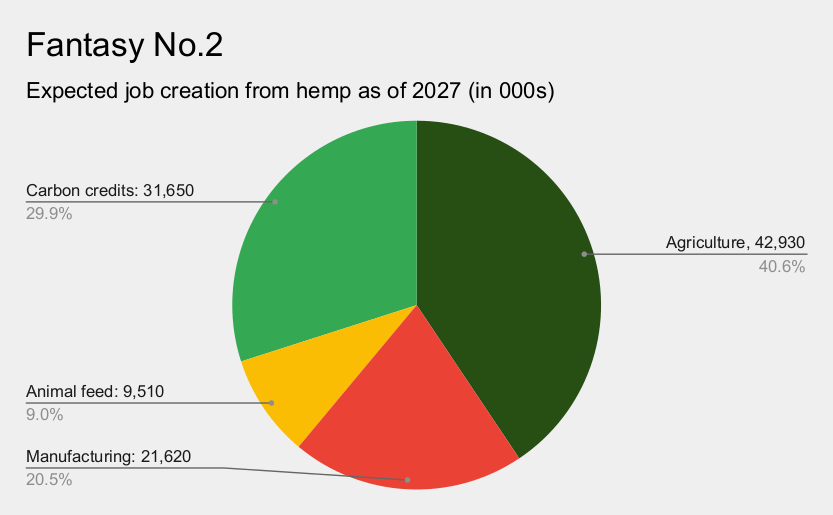

Released late last month, the plan, from the APPG’s Secretariat Advisory Board (SAB) suggests that UK farmers could be growing hemp on 220,000 hectares (~550,000 acres), generate £5 billion in income, and create more than 100,000 jobs by 2027 as the crop “future proof(s) the UK farming industry.”

Setting aside the fact that “future proof” and “farming” should never be used in the same sentence, much-needed licensing and other regulatory changes won’t be ready in six months, massive investment needed to develop multiple value chains for hemp processing won’t magically materialize, and, most certainly, British farmers won’t be growing a half million acres of hemp in 2027 – all breathtakingly projected in the APPG roadmap.

Cobbled together by the SAB with input from a number of stakeholder groups* who should know better, the “plan” is more hallucination than vision, grossly overestimating the potential for hemp farming, underestimating the bureaucratic process required to change regulations, and ignoring unproven market demand as it looks a short five years into the future.

Little interest

UK stakeholders have never really shown much interest in hemp, and little has been done to advance domestic production.

Only about 20 farmers in the UK now grow hemp on a total of 800 hectares, according to the APPG. Reaching 220,000 hectares in five years would mean a 27,000% increase! For context, consider: Hemp fields across the entire EU, where farmers have been working to build an industry for decades, total about 50,000 hectares at best; and U.S. farmers harvested just 33,500 acres (13,000 hectares) in 2021 after stakeholders there worked for nearly a decade to groom the playing field for industrial hemp.

Sloppy knitting

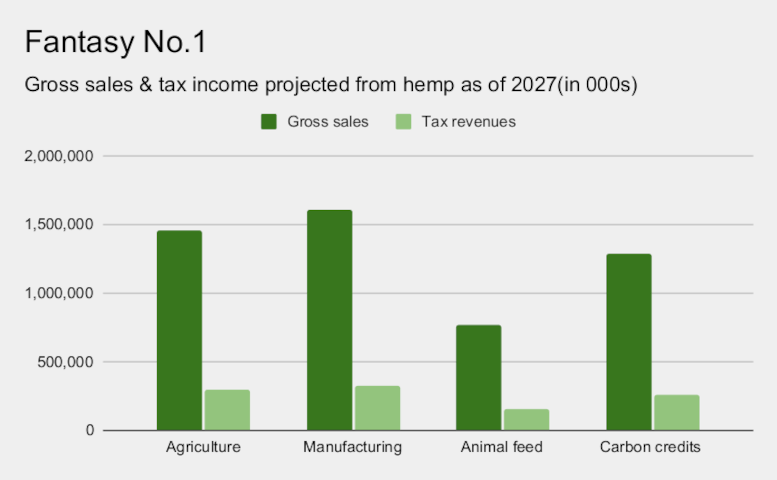

Oddly supplementing this misfortunate document, the APPG goes beyond delusions of a robust and thriving CBD value chain for some wild prognosticating in hemp sectors beyond its purview, flagging “multi-billion-pound downstream markets” it seems to know little about.

Hemp could be in 60% of all new homes in the UK by 2027 as hoards of hemp building crews presumably gorge on hurd (projected income: £240 million at £1,055 per hectare!). Trading in hemp-based carbon certificates, a wholly undeveloped proposition, would appear out of nowhere and then quickly soar to £1.2 billion, the plan suggests.

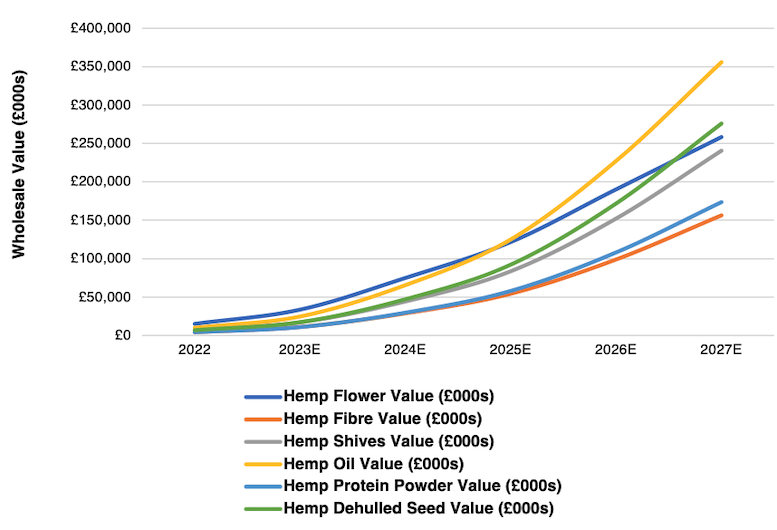

Imagined boomlets in flowers (~£250 million), hemp oil (~£350 million), dehulled hempseed (~£275 million), protein powder (~£160 million), bast fibers (~£170 million), and animal feed (~£765 million) are casually tossed about in the plan, heavily footnoted – and wholly unconvincing.

Swooping up to hemp nirvana

From the APPG plan: Hemp raw materials wholesale value

Unshackled from the EU!

Even when the APPG sticks to its knitting – CBD – its outlook is faulty.

Start with the inconvenient fact that production of hemp flowers needed for CBD remains illegal in the UK, with drug authorities still involved. With rules generally slow to materialize, it’s highly unlikely that a regulation to fix that fundamental problem will be in place by Feb. 1, 2023, as indicated in the plan’s timetable.

Unshackled from burdensome EU rules as a result of Brexit means the UK can set itself apart from the CBD pack, the plan observes, then joins the herd by acquiescing to a THC limit of 0.3% for hemp “on the field,” while urging a “review be commissioned” on the safety of higher limits.

In the truly avant-garde, Asian and Latin American countries have already adopted 1.0% as a THC limit, giving them the advantage of more efficient CBD production.

Similarly missing the boat, while acknowledging the UK’s absurdly low limit of 1mg or 0.0001% THC for consumer products, the APPG fails to offer any specific revision for that benchmark, a fundamental factor in establishing an advanced market.

Packed to the gills

Meanwhile, bubbling about the “opportunity . . . to streamline the process of adding new CBD products to its list of (Food Standards Agency) approved products,” the plan ignores the fact nearly 12,000 products are already on that bloated list, the food safety body’s roster of preliminarily approved new (“novel”) foods that is a part of regulators’ muddled efforts to clear up the gray market. The legal market for CBD is packed to the gills even before it opens to domestic producers, in other words.

“With government interventions aimed at improving regulations and enabling domestic production of CBD, the UK market in ingestible and topical CBD products could be worth £2.0b within 5 years,” the plan enthusiastically observes, as “the popularity of non-intoxicating CBD products is driving interest in cannabis and helping remove much of the stigma still attached to the plant.”

That number might work out, but the stigma persists, and has been supplemented by a latter-day stigma on investment in CBD following a historic global crash that is given scant notice in the APPG plan.

Green thing

Getting with that green thing, the APPG plan makes much ado about hemp’s potential in carbon mitigation, with the obligatory nod to the government’s environmental initiatives aimed at reaching “Net Zero” CO2 emissions by 2050.

But technical and many other factors are involved in both recording and verifying carbon capture, and credits exist in several categories, making projections difficult. And while the APPG plan hypes carbon credits as a way to “open up a new revenue stream currently unavailable to farmers, diminishing the need for subsidies,” it’s doubtful the credits could have a significant impact on the outlay of farmer-favored subsidies, which carry little risk.

Heading in reverse

All things considered, it’s impossible to envision UK hemp playing out as it does in the APPG “Plan for a Legal and Regulated UK Hemp and Cannabis Sector.”

Even in normal times, attracting the needed attention for industrial hemp isn’t easy. With the UK government in transition, the economy heading toward the shoals, soaring energy prices, sharply rising inflation, struggling exports, and rising interest rates, it will prove nearly impossible.

This unfortunate plan, under any scrutiny, certainly won’t do that.

Instead, it’s all speculation down the APPG’s primrose path to “a future-proof and thriving sustainable economy.” A trip in reverse, to when outlandish predictions for CBD were being bandied about in seminars, trade shows and investor presentations.

In that way, it takes the UK hemp industry back five years, not ahead.

Key proposals

Among recommendations in “A Plan for a Legal and Regulated UK Hemp and Cannabis Sector” from the APPG on CBD products:

- The Department for Environment, Food and Rural Affairs should be the authority for conducting administrative checks on all hemp growers.

- Administrative controls should be based on the verification of the official labels, proof of purchase, seed type and location.

- Remove the requirement on farmers to destroy field hemp if it exceeds the pre-validated level of 0.3% THC.

- The UK National List of seed varieties should include the EU varieties in the National List, and registration of new varieties should be expedited through a streamlined process.

- Research in genetic improvement and agronomy to expand the list of certified seed should be supported.

- Commission a review to determine a suitable limit of controlled cannabinoids in field hemp.

- Commission a review of a suitable THC limit in consumer products manufactured from hemp.

- Include only delta-9 THC in the measurement of THC levels.

- Develop standardized testing protocols for cannabis-based products and set clear definitions of different product types, based on the variety and potency of active substances.

- Ensure enforcement of Certificate of Analysis and Certificate of Origin requirements for food supplements, which should be issued by accredited laboratories using the FSA-approved testing protocols.

- Commission a review of the Novel Food Regulations and its application to hemp-based food supplements.

- Review the Advisory Council on the Misuse of Drugs recommendation to adopt a ‘serving-based’ approach to daily intake levels of controlled cannabinoids.

- Establish clear definitions of different product types based on the variety and potency of active substances, and provide labeling guidelines.

About the APPG on CBD Products

The UK All-Party Parliamentary Group on CBD Products is led by Parliamentarians Crispin Blunt and Zahita Manzoor, co-chairs, while the APPG Secretariat is financed and managed by Tenacious Labs, a company operating in plant-based ingredients, including CBD and Psilocybin. The Secretariat is headed by Nicholas Morland, Tenacious CEO, a chartered accountant with a background in private equity, commodities, finance and insurance; and Adrian Clarke, Tenacious COO, an investor and entrepreneur who has worked in the food and beverage sectors.

*The CBD APPG claims to have roughly 700 companies and organizations on its Secretariat Advisory Board (SAB), most through memberships on key trade bodies that are also SAB members. They are: The Medical Cannabis Clinicians Society, the Cannabis Trades Association, the European Industrial Hemp Association, the British Hemp Alliance (BHA) and the Cannabis Services Advisory Board (Jersey), all of which consulted on the APPG CBD plan.

Representatives of the Scottish Hemp Association (SHA) and the UK’s Cannabis Industry Council (CIC) were either removed or resigned from the advisory board in June amid a squabble over strategy.