[Second of three parts]

When it comes to the smackdown suffered by the U.S. hemp industry over the last three years, most injuries were self-inflicted.

As an assortment of charlatans pitched get-rich-quick schemes, and self-appointed “leaders” and “experts” amassed around CBD, the true potential of hemp – in the food, construction, biocomposites and other major sectors – got lost in the shuffle, and worse: The CBD hustle put a stink on hemp that has set the industry back years.

In the runup to passage of the 2018 Farm Bill and the months that followed, CBD products massively proliferated, showing up everywhere from marijuana dispensaries to the local gas station convenience store. Estimates by the end of 2019 showed that 13 million users contributed to a total market of $4.5 billion virtually overnight. CBD sales grew anywhere from 25-40% the following year.

But even that robust performance was well below expectations – the canary in the coal mine – for what was hyped as a “breakthrough” product.

What’s that smell?

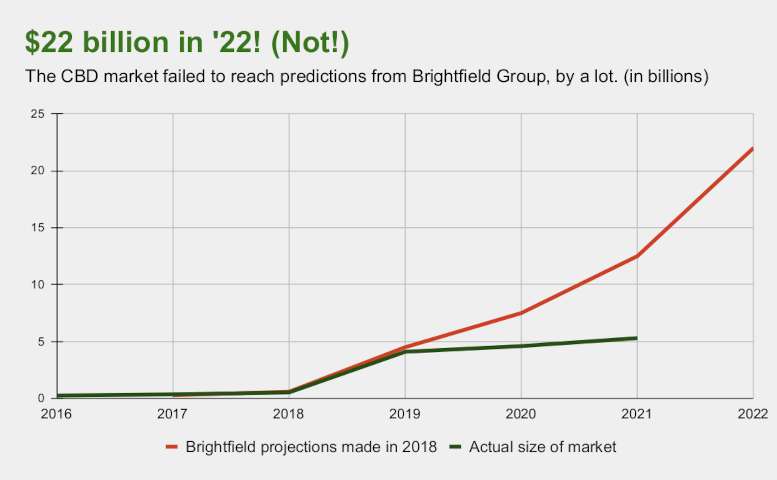

“Analyst” predictions had been rosy as stories of the fortunes to be made in CBD flowed endlessly. In its 2018 CBD report, data provider Brightfield Group famously predicted the market in the U.S. would grow to $22 billion by 2022. Those who scoffed appear to be proven right as the vision of products going into “big box” retail stores turned out to be a mirage.

In a report out last week, Brightfield’s most recent figures would have this year’s CBD sales remaining flat over 2021, at about $5 billion.

Further fueling the hype, over-the-counter (OTC) traded stock operators – that particularly odious form of the public company – pumped out breathless press releases extolling the Next Big Thing in cannabis to unwitting investors.

ALSO IN THIS SERIES

Part 1: With CBD gold rush over, U.S. Hemp is but a shadow of its former self

Part 3: (Friday) Ahead for the industry: Fiber and food, sure, but hemp will be relegated to a ‘specialty crop’

As the shit hit the fan beginning in 2019, the first victims were the ones most important to establishing a hemp industry in the USA: Farmers, who not only fell for the patter of dishonest middlemen – Grow for CBD and Earn $50,000 per Acre! Seed? You’ll get it free! – but also the misconceptions about hemp as a crop: It’s easy to grow, anywhere!

Hard lessons

Some farmers learned hard lessons, losing crops to pests and bad weather, and plants that exceeded THC limits which had to be destroyed. Harvesting costs and investments in equipment and technology were high. Some growers were late to realize that such things as drying facilities were lacking, meaning unplanned investments were often required.

But the most brutal lesson was the one about supply and demand. Farmers who managed to bring in crops – in the end, too many of them – did so as expected demand failed to materialize, with the number of users growing by just 13% to 14.8 million in 2020.

As the covid-19 pandemic took hold, estimates held that as many as 5,000 CBD companies were on the market. Some 90% of them are believed to have failed between 2019 and 2021.

Consolidation

As major producers scrambled, partnerships, mergers and acquisitions involving CBD makers and better-heeled marijuana-oriented companies heated up. Aurora bought Reliva, Canopy Growth and Martha Stewart merged, Molson Coors joined Hexo to form Truss CBD. There were notable others.

Farmers were meanwhile left with biomass backed up in their barns growing less valuable by the day, and under the pressure of payments on outsize capital investments.

Also besetting the industry, a leadership gap was evident in the management of hemp (again, primarily CBD) companies, often rooted in the naive “hemp-will-save-the-world” ethos but with little business acumen. Many also had little in the way of scruples, ripping off celebrities for fake endorsements and pushing out “miracle cure” advertising for their products, which frequently were of questionable quality.

Know your bureaucrats

The “wild west” atmosphere eventually drew the attention of regulators but not in the way many had hoped. Instead of fostering the CBD industry by addressing it with regulations, the U.S. Food and Drug Administration (FDA) started cracking down on advertising claims and issued warnings to producers.

In the CBD sector’s search for a bogeyman, the FDA makes a convenient target. And truth be told, the FDA has done little to support the research necessary as an underlying basis for CBD safety. But if stakeholders thought the FDA would join them in their heady enthusiasm for the next miracle product, they don’t know the agency, which always moves at a snail’s pace in approving new foods and drugs.

Amid all the hubbub, self-appointed hemp industry “leaders” blew up and refashioned legacy stakeholder organization the Hemp Industries Association in 2020, creating ill-will before moving on to engage in a series of frivolous lawsuits that made the industry look ridiculous, in the words of one judge. Some states gave up on local hemp programs, leaving farmers further adrift, and to operate under the federal government.

The CBD craze briefly shined a spotlight on hemp. But the close-up look proved to be ugly. In the end, it did real, and lasting, damage. It remains for those who see the plant for its broader potential to pick up the pieces.