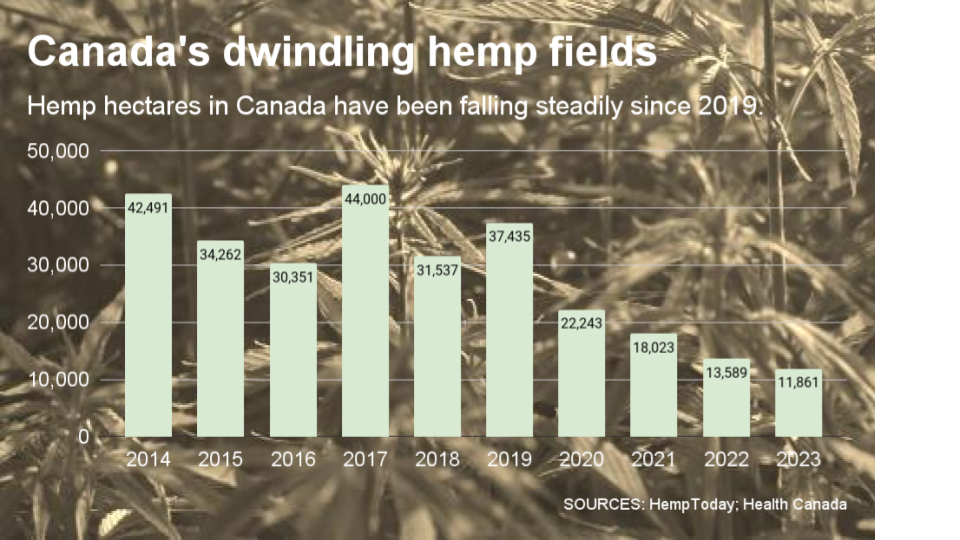

Licensed hemp fields in Canada continued to shrink, with 11,861 hectares (29,309 acres) recorded in 2023, down from 13,589 hectares (33,579 acres) in 2022, according to government statistics.

The 2023 results show industrial hemp at its lowest level since Health Canada, the government’s cannabis regulator, started tracking the crop in 2018. Canadian fields are one-fourth of what they were at a peak of 44,600 hectares (110,209 acres) achieved in 2017.

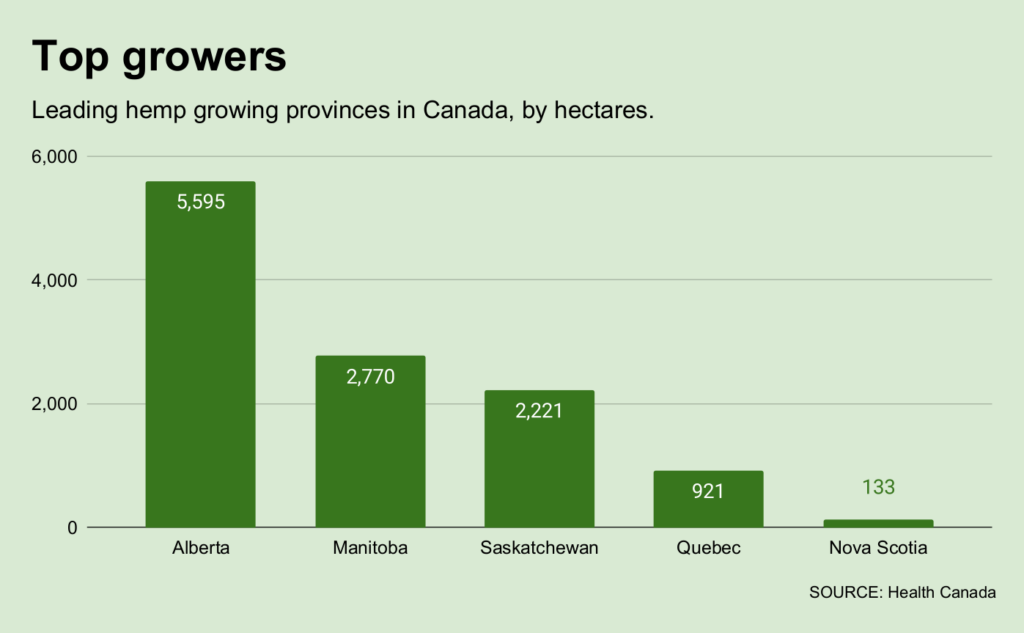

All three leading provinces saw their numbers fall. In Alberta, the number of cultivation licensees fell from 187 in 2022 to 130 in 2023 while hemp hectarage dipped from 6,532 to 5,595; the number of Manitoba farming licensees was 58 in 2023, down from 67 the year previous while fields dropped from 3,130 hectares to 2,270; Saskatchewan licensees were 75 in 2023 compared to 100 in 2022, and fields fell from 2,859 to 2,221 hectares.

Leading outputs

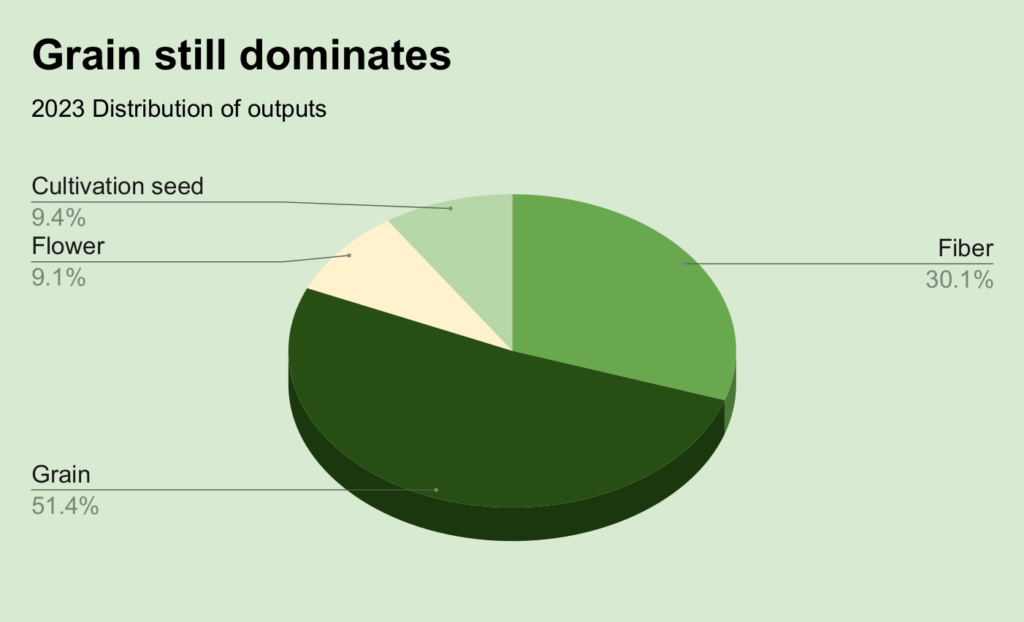

The annual report by Health Canada shows that the grain sector continues to dominate production, with 51% of hemp fields dedicated to that output in 2023. Crops grown for fiber were 30.1% of the total last year. Both subsectors saw hectarage fall by more than half in 2023 compared to the year previous.

Despite the downturn, Canadian hemp grain producers continued to dominate the U.S. market for hempseed-based products last year, shipping material valued at roughly $55 million south of the border, according to the U.S. Department of Agriculture (USDA).

Canadian producers shipped in $46.8 million worth of food seed, $5.0 million in oilcake and $3.6 million in hempseed oil, with most of the supplies coming from Manitoba ($43 million), according to final USDA import figures from last year.

Canadian hemp fields hit a modern-day all-time high in 2017, spurred by a boom in exports of grain to South Korea valued at about $35 million in 2016, as South Korean consumers, seeing hemp seed as an alternative to fish oils, took up the products, driven in part by aggressive tele-marketing programs. But Canadian exporters were hard-pressed to compete with Chinese producers, who quickly moved into the market with cheaper prices.

CHTA wants changes

The Canadian Hemp Trade Alliance (CHTA), the country’s leading industry group, has criticized the country’s regulators for what it says is a failure to recommend changes that would start treating hemp as a normal agricultural crop, and help reverse the decline.

Health Canada, which oversees both marijuana and hemp, said in a report issued in March that stakeholders informed the agency that the hemp industry in Canada has been negatively impacted by the legalization of marijuana in 2018.

CHTA has argued that all produce- and processor-facing hemp regulatory oversight and operations should be moved from Health Canada to Agriculture and Agri-Food Canada, the country’s farming agency, and that testing and other matters related to THC should be addressed. The Alliance also said regulatory issues that have arisen from Health Canada’s confusion between hemp and adult use/medical cannabis need to be clarified.