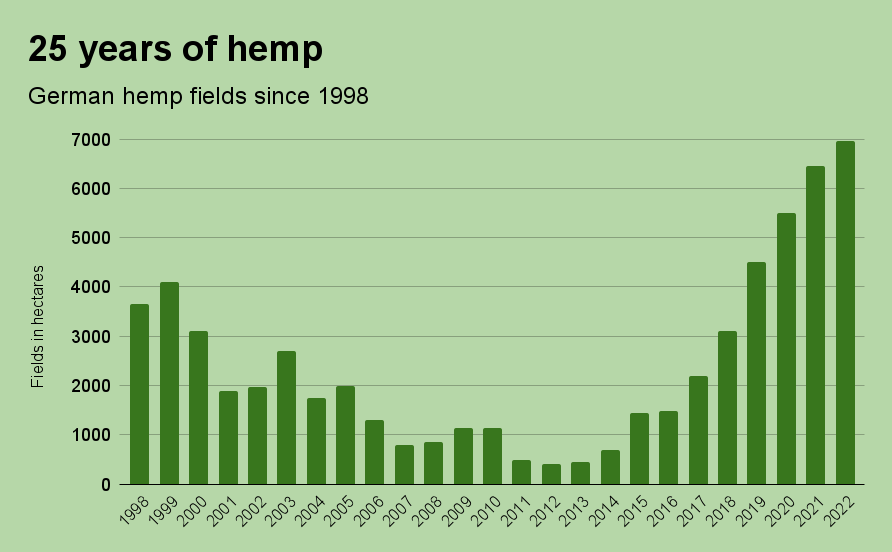

German hemp fields continued to expand this year, growing 7% to reach an all-time high of 7,000 hectares (17,000 acres) despite significant barriers faced by the industry.

Perhaps more important than total fields, the number of farms growing the crop has more than doubled in the last five years, with hemp plots increasing from fewer than 300 in 2017 to 889 in 2022 (+67%), according to statistics from the Federal Office for Agriculture and Food.

Fiber, feed demand

While demand for hemp food seed grows steadily, and the number of farmers growing mainly for fiber has seen a strong uptick, fundamental challenges remain, beginning with economics, according to Daniel Kruse, CEO at Düsseldorf-based Hempro International GmbH.

“Price levels still don’t pay off well enough for the farmers,” said Kruse, a longer-term structural indicator that could mean German farmers might eventually give up on growing hemp. That problem is compounded currently by the country’s struggling economy – which has seen inflation cut consumers’ spending power – and changing weather patterns that are bringing longer, hotter summers and rainfalls ill-timed for farming, Kruse noted.

Bureaucracy

Meanwhile, bureaucratic challenges continue to hold back Germany’s hemp industry, key among them outdated narcotics laws that have led to confusion. Authorities have raided hemp shops, blocked the legal cross-border sale of imported flowers and ordered some hemp foods off the market as the police and public prosecutors continue to interpret existing laws in a highly restrictive manner, sometimes failing to follow clear EU directives on hemp.

“Despite a record year of industrial hemp cultivation, the authorities continue to stand in the way of sustainable success with their arbitrariness and oppression,” said Kruse, current President of the European Industrial Hemp Association, and whose hemp interests span farming operations, grain processing for food products, CBD, health and beauty products, clothing, and bags and accessories.

Dual cropping is key

Hemp first re-emerged in Germany in the 1990s, with fields quickly reaching 4,000 hectares in 1999. Producers in Germany focused mainly on growing for hempseed-based foods and fiber throughout the first two decades of the 21st century. That left legacy hemp companies in Germany (and elsewhere across the EU) well leveraged, and able to weather the CBD boom and bust that hit the market starting in 2019. While the CBD windfall was short-lived, many hemp companies have pre-existing business, established supply chains, and market-proven non-CBD products to fall back on.

Nonetheless, longer term, hemp farmers will find the economics falling short if they don’t plan their hemp operations for dual outputs: flowers for CBD extraction and leaves for hemp tea, or flowers and fiber, Kruse warned.

Bright side

Hemp is likely to remain a niche crop in Germany for years to come (German farmers grow wheat on about 3 million acres, for comparison). Still, Kruse, a 25-year veteran of hemp’s ups and downs in Europe, remains optimistic about Germany’s potential with the crop.

“Despite all obstacles the outlook for Germany, especially in the context of hemp’s potential amid rising concern about the environment and EU’s attempts to address climate change, is positive for sure,” he said.