A Swedish lawyer said he has identified as many as 170 individuals, banks and companies with connections to a massive cannabis fraud he claims bilked investors out of as much as $2.5 billion in an expanding international scandal based in Europe.

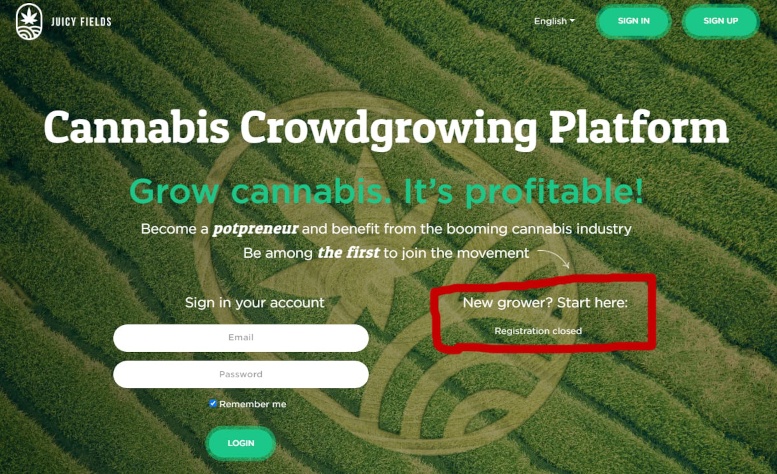

Malmö-based Attorney Lars Olofsson said he expects to file a class-action lawsuit by the end of November in the wake of the collapse of Juicy Fields B.V., a Holland-based fintech company that offered “per plant” shares of cannabis crops through a crowdfunding platform that eventually reached as many as 125,000 investor accounts. The company blew up this past July.

Olofsson is preparing the suit on behalf of nearly 800 plaintiffs from 50 countries against banks, lawyers and several social and news media outlets that he said helped facilitate investments into Juicy Fields. His claims address 70 individuals, 60 banks, and 40 companies, including major social media and news platforms Facebook, Instagram, Forbes, Google, CNN, and YouTube.

Targeting facilitators

“All of them have allowed JuicyFields to expose themselves on their platforms or magazines, and not just normal accounts but paid ads,” Olofsson told Green Market Report.

Olofsson also said the case will hold to account banks that processed millions of transactions for Juicy Fields, as well as government financial regulators in Germany, Holland, Switzerland and Cyprus “for a gross lack of their financial authorities, having not seen what was going on.”

Olofsson said lawyers serving the cannabis sectors will also be targeted in the lawsuit. “There have been a number of high-profile lawyers who have made a name in the international cannabis business, advocating for legalization and having a clean industry that’s free from crime and shady business,” he said.

Where’s the money?

Olofsson’s legal strategy is aimed at accountability of agents that fostered the alleged fraud at Juicy Fields. Attempts to hold company officers and directors financially responsible will prove fruitless, he said: “I know they have run away with the money. There is no use to find the money, that’s for sure.”

Companies and individuals based in Cyprus, Germany, Netherlands, and Switzerland played roles in the development of Juicy Fields, according to the attorney. “Several companies, organizations and individuals have facilitated this,” Olofsson told Investor Times. “An operation like this could never operate in a vacuum. It needs all kinds of suppliers who directly or indirectly facilitated or looked the other way.”

The scheme

Juicy Fields B.V., the Dutch company targeted by Olofsson’s suit, is a subsidiary of Juicy Fields GmbH, which was founded in Germany in 2017 by Viktor Bitner, a German citizen who Olofsson said has Russian ties, as a “research & development company,” according to the attorney. The company, which started operations in 2020, also has a Swiss subsidiary, Juicy Fields AG, and apparently operated in Spain.

Observers have called JuicyFields a classic Ponzi scheme in which operators pay out high dividends to early investors with funds from those who invest later. Positive buzz from those earlier investors attracts additional ones. The scheme usually ends when the operator’s owners block accounts and disappear with all investors’ money.

Investors first became concerned in early July when Juicy Fields’ IT, customer support and payments teams publicly announced a strike over disputes with management. The investors then found the Juicy Fields’ website shut down, leaving them locked out of their accounts.

Unregistered

Although Juicy Fields was legally registered in countries such as Germany and the Netherlands, it was not licensed to offer financial services, regulators in those countries have said. FINMA, the Swiss financial supervisory authority, has also said that Juicy Fields has no authorization to sell shares in Switzerland.

In Germany, the company was banned from receiving investments and fined by the Federal Financial Supervisory Authority (BaFin) in June. Warnings about the company were issued in both Germany and Spain that month.

The Berlin Public Prosecutor’s Office started investigations against 12 persons in August as the Berlin State Criminal Police Office and BaFin agents searched the apartments and business premises of five companies at two locations, seizing documents. Law officials have said their probe is intended to clarify whether the cannabis plants that drew investors actually existed or whether Juicy Fields was a scam.

Spanish case

Spanish attorney Emilia Zaballos said she is representing more than 900 people in a separate class action suit already filed that alleges fraud, embezzlement, money laundering and misleading advertising on the part of Juicy Fields operations in Spain.

Roughly 4,000 investors in Spain are among as many as 300,000 worldwide victimized by the Juicy Fields scheme, according to some estimates. Zaballos said her firm has received more than 6,000 inquiries regarding the company.

While Olofsson’s suit targets Juicy Fields’ facilitators, the lawsuit in Spain is directly taking on companies and principles in Juicy Holdings BV (Holland), Juicy Grow GmbH (Germany) and a number of individuals, including all those involved in the Spanish operation.

Who owns Juicy Fields?

A document uncovered by Investor Times early in the investigation shows that Paul Bergolts, who carries a Russian passport, controlled 51% of Juicy Grow GmbH, the company’s German operation, and 51% of Switzerland-based JuicyFields AG.

Robert Laibach, who has been identified as a Russian lawyer, held the remaining 49% of the two companies, the document shows. Those investigating the case have said those shares actually belong to two other Russian citizens, Alex Vaimer and Vasily Kandinski.

Olofsson has said the scheme bears many of the hallmarks of scams typically perpetrated by Russian mafia groups.

The company continues to operate a website where it purports to be giving refunds, saying it has returned $250,000 in 52 cases. A bizarre video of a company “anti-crisis” committee that showed up on the site this past week suggested Juicy Fields is working on “recovering the business system and returning millions to the e-growers.” Several observers have said the continuing communication through the website is simply part of a scam that is ongoing.

SOURCES: Cannabis101.de, Green Market Report, Investor Times, juicyfieldscase.com, confilegal.com