Poland has eased the way to market for hemp with updated regulations that raise the THC level from 0.2% to 0.3% and simplify permitting – further normalizing industrial hemp in one of Europe’s biggest agricultural countries.

Under new rules from the National Agricultural Support Center (KOWR) made effective this month, farmers and buyers must register only when starting a business, with annual permits no longer required.

Once licensed, farmers must only keep their local KOWR office informed if they change the varieties they are planting, increase the total area planted, or relocate their fields, KOWR said in a recent policy announcement.

The rules changes reflect modifications in Poland’s drug and other laws regarding the farming of hemp and poppies.

‘Mainstreaming’ hemp

“Apart from less bureaucracy, the bigger news is that this shows political will, a sort of mainstream acceptance of the hemp industry as such,” said Maciej Kowalski, CEO at leading Polish hemp company Kombinat Konopny. “The wide ‘left-to-right’ support among MPs for this project promises hope for further changes that could create business opportunities, jobs and tax revenue.”

The change in the THC level anticipates a similar increase the European Parliament approved last October when it voted to boost the authorized THC limit for industrial hemp “on the field” from 0.2% to 0.3%. That change is expected to come into force across the European Union in 2023.

The updated rules for Poland indicate buyers must conclude crop purchase contracts by July 15 of a given year, and provide written notice of the agreements to their local KOWR by the end of that month.

It remains unclear if farmers must have sales agreements for their outputs in place before sowing their fields. Polish growers have been required in the past to declare their hemp fields and show contracts in autumn before the next year’s planting season. A proposal floated last October would entirely eliminate the pre-sales contracting obligation.

Aside from bulk sales to third parties, Polish farmers may plant up to one hectare of hemp per year for their own needs, under the updated regulations.

In sync with EU

The changes are a sign of continuing normalization of hemp in Poland, according to Kowalski.

“Raising the legal limit of THC to 0.3% brings Polish regulations up to date with the European average and makes cultivation safer for farmers, allowing for a wider variety selection,” Kowalski said.

In addition to taking permitting decisions out of the hands of local county clerks, who are ill-informed about hemp and often equate it with drugs, the procedure to obtain a permit is now faster as it eliminates paperwork for both growers and administrators, Kowalski added.

In an earlier signal that the Polish market is moving toward rationalization, Poland’s highest administrative court last year ruled against the country’s main public health agency and affirmed the legality of unprocessed products made from the hemp plant’s flowers and leaves. The landmark case, brought by Kowalski’s company, affirmed the long history of consumption of hemp herb both as food and as a supplement to a normal diet, and ruled that such plant-top material is not subject to food safety rules governing new or “novel foods.”

Overcoming THC problems

The previous 0.2% THC limit had hampered Polish hemp farmers. For example, last year, the Agency for Restructuring and Modernization of Agriculture blocked farm supports for Polish farmers planting FINOLA after the variety was found to be above the European limit of 0.2% THC in tests the previous two years.

“Poland has ideal conditions for industrial cultivation, and raising the THC limit to 0.3% allows safe cultivation of all European varieties,” said farmer Patryk Czech of Afori sp. z o.o., a vertically integrated company focused on grain, fiber and hurd production.

Legal outputs identified by KOWR include textiles, chemicals, cellulose and paper, cosmetics, pharmaceuticals, energy products; grain for food, veterinary, fodder, beekeeping and fertilizing purposes; and building materials, composites, and natural plant protection products.

The changes should especially expand opportunities for those growing hemp for the energy and building sectors, Czech suggested: “These are the sectors that can justify growing hemp on a large scale.”

Opportunities

Farmers can also grow hemp for land reclamation and remediation, and research and development including breeding for new hemp varieties.

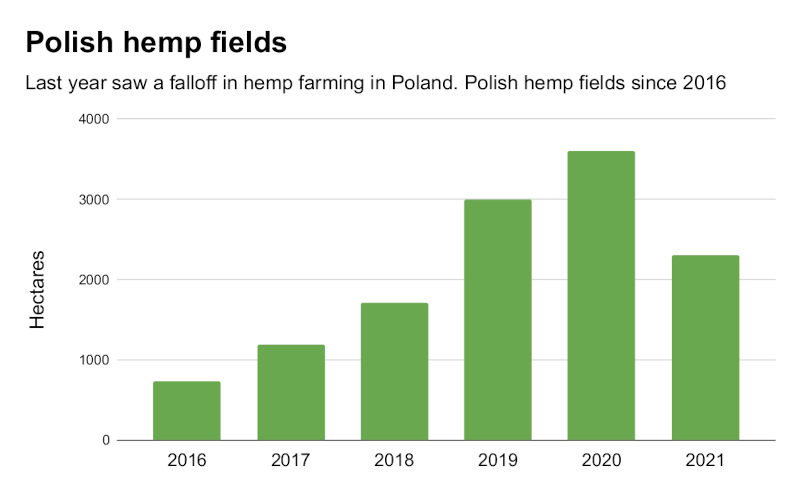

Stakeholders have said the regulatory changes can spark pent-up interest among farmers and result in more and more fields dedicated to hemp. Polish hemp companies can capitalize on the growing domestic demand for healthy, eco-friendly products, and export hemp food products to other European markets where Poland’s food industry already has a footprint.

Poland’s hemp sector produces straw for fiber and hurd, seeds, and flowers for CBD-based products. Cultivation seeds from some Polish hemp varieties are finding a market in other European countries and North America.