CanXchange, a London-based hemp trading platform, said it has enhanced its interface and now looks to add more buyers and sellers as it aims to fill what the company sees as a critical gap in the burgeoning industry.

“To become a global commodity, the industry needs a professionally structured marketplace where buyers and sellers can view offers, negotiate and trade efficiently and securely,” George Popov, the company’s Chief Strategy Officer and a co-founder, told HempToday. “We’re providing the trust factor in the middle.”

Such marketplaces provide a range of intermediate services and tools that assure those on both ends of the transaction are trustworthy. CanXchange said its proprietary payment solution overcomes a chronic barrier to the industry by providing transactional certainty and ease for users of the platform.

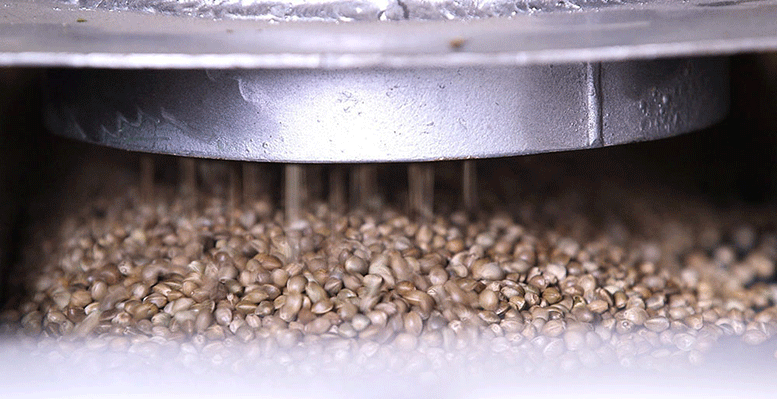

CanXchange will offer trading in hemp-derived distillates, crystal, isolate, hemp biomass, oil and seeds, with plans to expand its portfolio. The platform aims to connect dependable farmers, producers and extractors with a wide range of industries on the buying side in a secure environment, the company said.

Security tools

To do that, CanXchange has integrated a number of tools through Thomson Reuter’s Refinitiv service that supports due diligence investigations critical in fighting financial crimes and corruption. The service scans worldwide public and private databases to identify security issues.

Once vetted, buyers and sellers can access the platform to interact anonymously until a transaction is completed. Buyers must deposit the full amount of the transaction value with CanXchange towards any purchases; both buyers and sellers are charged negotiated commissions.

Quality assurance

To ensure quality, CanXchange is using a laboratory affiliated with the Prague-based University of Chemistry & Technology to analyze goods offered on the platform. Samples may also be ordered by purchasers, who have time to check the goods after receiving full shipments. Funds to the seller are released by CanXchange only after the purchaser’s approval. “Most important is that the buyer’s money stays safe until they are satisfied,” Popov said. “If there’s a dispute, we become referee and find an amicable solution between the buyer and seller.”

Founders

CanXchange was started by a group that includes former investment bankers and other executives who are specialists in commodities such as oil, sugar and metals, and who have backgrounds in trading, technology, client service and the hemp industry.

In addition to Popov, who has sales and trading experience with Barclays Capital and Merrill Lynch, other principles in CanXchange include: Alex Arkentis, CEO and co-founder, a technology entrepreneur and investor; Sigfried Legeay, CFO and co-founder, a former trader at BNP Paribas; Riccardo Ravaro, a web development expert; Mary Dodman, a marketing executive previously with British luxury brand Burberry; and Joe Spencer, a hemp industry consultant.

Why Europe?

Popov said CanXchange started in Europe because CBD and hemp markets are more established on the continent, but major European players contacted by HempToday say that while such highly-secure marketplaces are needed, the industry may not yet be ready for them.

“We’re definitely interested in looking at these kind of platforms,” said one major player. “The main obstacles will be the current market situation itself, the (hemp industry) regulatory issues we’re currently fighting, and the lack of time companies have to take advantage of all these options in the internet.”

“Other such platforms have tried and failed, in both North America and Europe,” that source noted.

Said another: “It’s just too early for commoditization of hemp because it will drive down prices for current players, most of which are small and at early stages of development.”

End-to-end system

CanXchange said earlier initiatives had bad timing and lacked the sophisticated payment system it has created, suggesting previous attempts to establish trading platforms could complete only 20% of the purchasing process.

“Companies who have attempted similar business models in the past have not succeeded due to the fact that they arrived in the space too early. Timing is key,” said Arkentis, the CEO. “Most importantly, they didn’t consider important features that we have now implemented, including a payment solution operated through the conventional banking system, centralized lab testing, a sophisticated KYC & due diligence process, and effective logistics management.”