While North Carolina hemp farmers all but abandoned the flower market, flower-derived CBD products continue to flood the state, underscoring consumer safety threats amid a yawning regulatory gap.

Growing and processing flowers for CBD drove hemp’s growth in North Carolina until that market became oversaturated beginning in 2020. While flower growers have now pulled back, CBD products have flooded the market in the state amid lax or absent regulations to guide retail sales. No licensing scheme exists for sellers, and the products are not age-restricted, for example, to name just two fundamental challenges.

“It’s a weird state of affairs; a very unsettled state of affairs,” Phil Dixon, a professor at the University of North Carolina (UNC) School of Government who has followed the state’s fortunes with industrial hemp, told ABC 11 television.

No state program

North Carolina chose not to organize a program for hemp production after a state pilot ended in early 2022. The state no longer regulates production and processing, which is now directly under the U.S. Department of Agriculture (USDA). That agency monitors hemp only before it is processed.

North Carolina is among many states struggling with CBD policy in the absence of federal regulations regarding finished products that are offered to consumers. Some states have drafted local rules but North Carolina has yet to do that. The state complies with U.S. Food & Drug Administration (FDA) regulations that prohibit CBD in food, unsubstantiated medical claims, and labeling CBD as a nutritional supplement, but there are no laws that restrict CBD sales by anybody with a business license.

“There’s a little bit of federal regulation from the FDA as far as how it can be marketed, what kind of medicinal claims can be made and restrictions on putting it into food or drink,” Dixon said. “But those are not widely enforced, and there is still no real protection for consumers, such as quality assurance or testing for contaminants.”

FDA late last month said federal safety standards are insufficient to manage the CBD industry, and called on Congress to set rules for the products through legislation. The agency said not enough is known about CBD products to regulate them as foods or supplements under the FDA’s current structure.

Fewer products tested

Whatever CBD processors remain in North Carolina, many are reported to be eschewing laboratory testing to cut costs amid the ongoing CBD crash which started in 2020, when CBD biomass began to back up in barns all across the U.S. Products that are untested put consumer safety at risk, said Volker Bornemann, whose Durham-based Avazyme agriculture and food testing company started hemp lab services in 2015. Bornemann said he has seen the hemp testing part of his business shrink from 15% to less than 5% of overall revenues.

“The sources are sometimes different from what they claim they are and the product composition is not what it says on the box,” Bornemann said of products currently on the market.

“Especially, the delta-8 THC products are often quite dirty,” Borneman said of the popular psychoactive form of THC which is derived from CBD through a synthetic process – and which many other states are struggling to control. Delta-8 content is often much lower than advertising and labeling indicate, while amounts of delta-9 THC that comes from marijuana plants can be double the 0.3% federal limit for hemp, according to Bornemann. (That’s a red flag indicating products being sold as delta-8 THC could be spiked with delta-9 to boost overall THC potency.)

Adulterants found

Bornemann said testing in his lab has also revealed adulterants such as heavy metals, pesticides and mycotoxins in product samples.

“Right now, the consumer is really taking a big, big risk, consuming these products because they are not adequately tested and you don’t know what you’re buying,” Bornemann said.

Adding to the risks, some gray-market CBD products available online in North Carolina have been selling for more than approved medicinal CBD prescribed by doctors, a team of researchers from two state universities reported in a paper last year that referred to the situation as a “paradoxical disconnect” in the market that also threatens consumer safety

The paper called for state policies that limit access to non-pharmaceutical grade CBD products promoted and sold online and “a more efficient strategy” to enforce federal and local regulations.

Hemp reset: Fiber

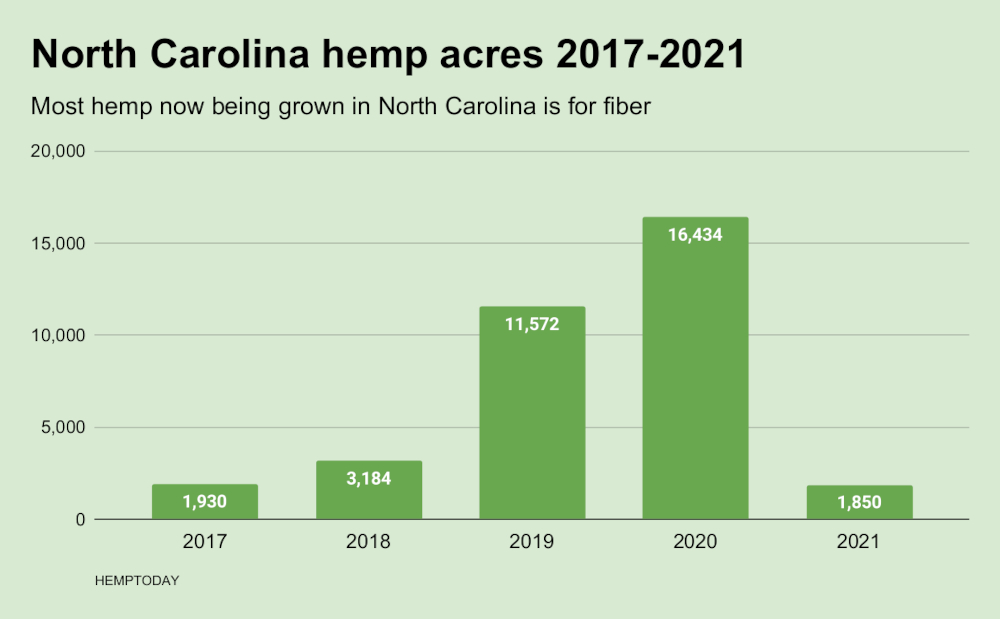

With CBD in full swing in 2020, North Carolina growers hit peak acreage of more than 16,000 acres, and saw the number of growers double between 2018 and 2021. The state recorded nearly 1,300 registered processors in 2020, according to data from the North Carolina Department of Agriculture & Consumer Services. (Other sources put that number as high as 1,500).

A year later the state’s farmers harvested just 1,850 acres after planting 2,150, according to the first-ever report on the crop from the U.S. Department of Agriculture’s (USDA) National Agricultural Statistics Service (NASS), released in February 2022. Fiber hemp accounted for 1,550 acres while North Carolina farmers grew just 77 acres of hemp for CBD in 2021, NASS reported.

State interests have pushed hemp as a rotation crop, and as a replacement for North Carolina’s declining tobacco fields, a strategy that could also apply to an expanding hemp fiber sector.

In signaling a turn in that direction, at least four fiber processing operations are expected to have production lines running in the state by 2025, according to a recent report from analyst PanXchange. Among them is a Pennsylvania company which last autumn said it plans to invest $10.9 million in a new hemp fiber processing facility in North Carolina with the support of the state, educational institutions, economic development and municipal authorities.