FDA’s scrutiny of hemp in USA hits Euro exports; Questions plague CBD market

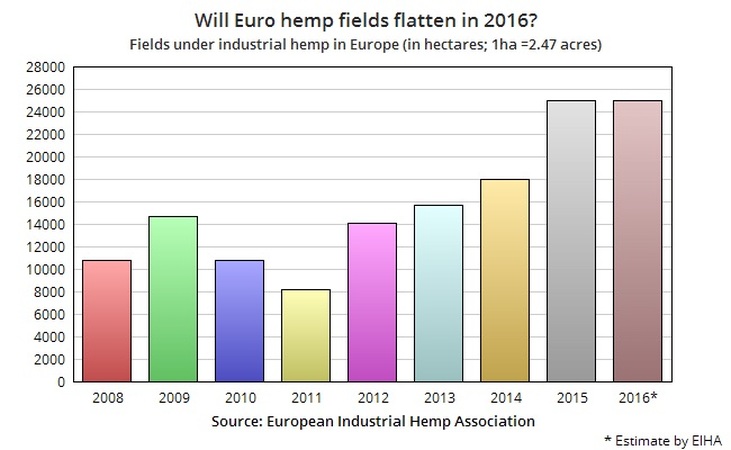

The European Industrial Hemp Association (EIHA) projected hemp will be planted on a total of 25,000 hectares across Europe this spring, roughly the same amount planted on the continent last year and indicating a slowdown in the growth of hemp farming following a four-year climb. European hemp fields tripled between 2011 (8,196 ha.) and 2015, according to EIHA figures, generally considered to be the most comprehensive data on Europe’s hemp markets.

The prediction for this year’s hemp fields came in a press release from EIHA Feb. 26.

Drop in exports to USA

The slowdown is due mainly to a sharp drop in exports of various hemp-based health products to the USA where the Federal Drug Administration (FDA) has started to scrutinize U.S distributors and warned some against making misleading health claims about their products, Europe-based sources say. More than half of Europe’s processed raw hemp materials for such products had been going to the United States before the FDA issued its warnings to sellers there whom the FDA suspects of making questionable claims regarding cannabidiol (CBD).

A derivative of low-THC industrial hemp, CBD has shown promise in treatment of a variety of illnesses and is marketed as a health supplement. It has long been considered the financial holy grail among the many products derived from the hemp plant.

Long-term outlook

Along with current hurdles at the U.S. border, the promise of Europe’s CBD market is held back long-term by both a lack of clinical research and a slowly evolving regulatory landscape, said Hana Gabrielova of the International Cannabis and Cannabinoid Institute (ICCI), which is developing international standards and practices for the marijuana and CBD-based medical industry.

Based in Prague, ICCI was started by American entrepreneur and environmentalist Benjamin Bronfman. At the center of the group’s work is a Patient Focused Certification (PFC) program that assures compliance with a wide range of other standards for medical cannabis products, according to ICCI.

“The goal is to establish global quality standards to control the whole production chain,” Gabrielova said.

Investment needed

Meanwhile, the CBD market also suffers from basic infrastructural challenges, according to Joe Spencer of Hemp Broker Europe, which is working to create partnerships along the value chain to grow the overall CBD sector.

“The lack of investments into hemp farms from CBD producers has placed large financial risks on many farms who want to support development of the CBD industry,” Spencer said.

Lack of trustworthy CBD producers, a market saturated with low quality CBD hemp paste, a lack of processors experienced with CBD formulas, and restrictive sales channels are also challenges facing the sector, Spencer said.

“These production chain challenges have created a blockage in the sales channels, which support a distribution network of aggressive resellers focused on sales instead of the production requirements of buyers,” Spencer added.

Facts & figures

- Across Europe, the EIHA’s hemp field report for 2015, released last autumn, showed France as Europe’s biggest hemp grower with 11,450 ha under the crop in 2015. Rounding out the top five were Lithuania (2,367 ha); Italy (2,070 ha); Croatia (1,600 ha); and Germany (1,486 ha).

- Pure CBD isolate, the most valuable hemp derivative, is currently priced between €20,000-€30,000 per kilogram around Europe, according to the EIHA. The flowers needed to derive that substance are at €5-€50 per kilo, depending on quality and CBD levels, according to HempToday sources who say they expect those prices to remain stable despite the current market situation in Europe.

- Hurd processed for hempcrete is selling for between €350-€360 per ton on the continent, and sources say the straw is available, however transportation costs can considerably impact the end price.

Europe’s hemp outlook

Bright spot – Food: The European Industrial Hemp Association (EIHA) has noted that the hemp food market is steadily growing. “In 2015, hemp food products entered the mainstream . . . and were produced by well-known companies” into such products as hulled hemp seeds, protein powder and high-nutrition oils, the EIHA noted. “You can see this at Biofach,” the organic trade fair held last month in Nuremberg, said Hana Gabrielova, CEO of Hempoint, the Czech-based producer of a range of hemp food and health products. “There are more and more exhibitors,” she said.

Potential in fibers: The EIHA pointed to potential for the hemp fibers market where hemp is “particularly well established” as base material for natural fiber composites (NFCs), which are used for the reinforcement of automotive interior parts, for example.

“Due to their huge potential in lightweight construction, the demand for NFC has been growing continuously,” EIHA said, noting Europe’s potential to address that global market. “Whereas exotic natural fibres from Asia are suffering from limited availability because of the local competition with food crops and temporary export bans, European hemp fibres can meet increasing demands – if the demand is communicated before the sowing time in March,” EIHA said.

Hemp building slow but steady: Workshops and seminars proliferate across the continent, and notable projects already completed in the residential, retail, warehousing and commercial sectors demonstrate hemp’s viability in construction, as HempToday has documented over the past year. But that sector needs broader acceptance among mainstream and so-called “green” builders, Steve Allin, Director of the International Hemp Building Association, has told HempToday.

Allin said he expects steady but slow growth in the hemp building sector over the next few years, and sees opportunities for retrofitting existing structures to make them more energy efficient. That could help to underpin demand for hemp hurd, which is used in hempcrete, and for hemp fibers used in insulation.

Also, both the energy efficiency and C02 absorption properties of hemp buildings could attract European Union funding. Various EU programs are aimed at meeting Europe-wide 2020 C02 emissions goals adopted at the COP21 climate change conference in Paris last December.